Dodd Frank Section:

(unintended consequence of Dodd Frank)) Interview with Stanford Law Professor Joseph Grundfest About the State of Securities Class Action Litigation - by Kevin LaCroix - … Q. … What are directors most concerned about these days? Are there particular liability exposures that you think directors are worried about? A: Thoughtful, honest directors are most concerned with the implications of Dodd-Frank’s bounty provisions. In an ideal world, … Now, however, these directors find themselves in competition with the SEC which stands ready to offer significant financial rewards for the provision of information that might otherwise go to compliance authorities within the corporation. Honest directors, standing ready to remedy all violations brought to their attention, will now be frozen out of the information market because they simply can’t compete with the significant bounties available under Dodd Frank. … - D&O Diary

————

Budgets one way to "throttle" Dodd-Frank: Garrett - The head of a congressional panel that oversees U.S. financial regulation said on Tuesday that budget restraint is just one way Republicans are trying to "throttle" some of the Dodd-Frank banking reforms. U.S. Representative Scott Garrett, the Republican chairman of the House capital markets subcommittee, said he knows Democrats accuse Republicans of trying to throttle Dodd-Frank by restraining the budgets of agencies that must implement it. "That’s probably true too. We’re trying to throttle it in ways other than this," Garrett said in an interview. – Reuters

Q+A - What’s next for the Federal Reserve? - Reuters

————

(credit ratings yes or no?) Dodd-Frank & Basel III: A Round Peg and Square Hole? - By: Ash Bennington - To put it simply and bluntly, Dodd-Frank & Basel III have components that are logically contradictory. Principal among the contradictions is the handling of credit ratings. Dodd-Frank Wall Street Reform and Consumer Protection Act seeks to limit their impact—while Basel III seems to default to them, as a lesser of evils, in the framework for determining capital requirements for risk weighted assets. - CNBC

————

Other Government Related News

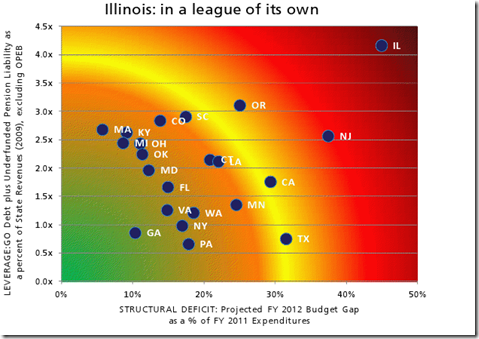

The Planet Illinois - John Ellis - JPMorgan Chase Private Wealth Management guru Michael Cembalest’s most recent dispatch includes the graphic below, which gives you some idea of where things stand in Illinois. (Look at this closely. the Vertical axis is how much we are underfunded to pay pensions. The horizontal axis shows how much more we spend in 2012 vs 2011 (structural deficit) - BC) - Business Insider

————

Financial Crisis Panel to Deliver Three Conclusions - By Robert Schmidt and Phil Mattingly - The federal commission that investigated the origins of the financial crisis is set to issue three competing conclusions next week. The Financial Crisis Inquiry Commission’s main report, to be released Jan. 27, is backed only by the panel’s six Democratic appointees. The four Republicans have written two separate dissents, according to a blog post by one of them. – Bloomberg

Treasury May Shrink Fed Borrowing by 98% as Debt Limit Bumps Into Ceiling - By Rebecca Christie and Liz Capo McCormick - The Treasury Department will probably reduce its borrowing on behalf of the Federal Reserve as the Obama administration and Congress battle over raising the U.S. debt limit, according to Wrightson ICAP LLC. - Bloomberg

————

"Zero-Interest Policies as Hidden Subsidies to Banks" - Mark Thoma - Axel Leijonhufvud argues … The Fed policy drives down the interest rates paid to savers to some small fraction of 1%. At the same time, banks leverage their capital by a factor of 15 or so, thus earning a truly outstanding return from buying Treasuries with costless Fed money or very nearly costless deposits. Wall Street bankers are then able once again to claim the bonuses they became used to in the good old days and to which they feel entitled because of the genius required to perform this operation. These bonuses are in effect transfers from tax-payers as well as from the mostly aged savers who cannot find alternative safe placements for their funds in retirement. … - Economists View

————

Support for Fannie, Freddie Hybrid - by Peter King - A public-private entity is likely the best way to reform troubled lenders Fannie Mae and Freddie Mac in order to ensure low-cost mortgages while limiting taxpayer exposure to future bailouts, a new report from Moody’s Investor’s Service has concluded. The report, which analyzes potential reform scenarios for the two troubled mega mortgage lenders, is only one of several calls this week for reforms to the two lenders, which support the majority of the U.S. mortgage market. The Moody’s report concludes that a middle path will likely come the closest to achieving the government’s objectives for reform, as opposed to complete privatization or turning them into public agencies - NASDAQ.com

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment