PLAN ORANGE - an answer to the mortgage crisis - Michael White - New Mortgage Company - all we need is $5T

————

How to Fix America’s Housing - Felix Salmon - Ed Glaeser’s massive, 3,000-word TNR review of the new book by Robert Ellickson is a thought-provoking must-read for anybody interested in the dynamics of the housing boom and bust, and the policies which should be followed now. I’m not going to try to summarize it, but I do want to annotate a few passages. … Remember this fact — that existing loan servicers are simply not up to the task of maximizing mortgage values. It’ll be important when we get to bankruptcy in a minute … - portfolio.com

————

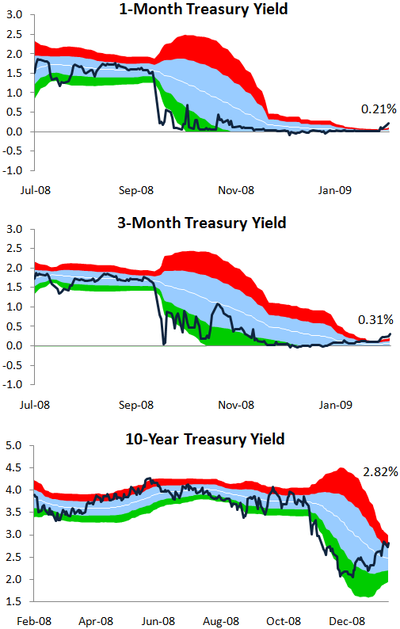

Money Coming Off The Treasury Table - After floating around the 0% level for a couple of months, yields on 1-Month and 3-Month Treasury Bills have finally started to move higher over the past few days. - Bespoke Investment Group

————

2 from Analytical Wealth Blog:

1. Option ARM Defaults as high as 61% - Here is a look at the wave of rising defaults of Option Arm Mortgages:

2. Quick Clarification: Mortgage Slaves - Yesterday I wrote a post on “Mortgage Slaves” where I suggested that people who are fighting foreclosures on homes they could never realistically afford, should just cut their losses and walk away. … However the above only applies to people who can’t realistically afford their mortgages, not those who just find themselves upside down. …

————

FRB Atlanta Working Papers 2009-1 and 2009-2 now online

1. Subprime Mortgages, Foreclosures, and Urban Neighborhoods- FRB Atlanta Working Paper 2009-1 - The authors find that homeownerships created with subprime mortgages have proved unstable and that the dire situation foreclosure has created in urban areas makes it easier for policymakers to provide remedies.

2. Making Sense of the Subprime Crisis - FRB Atlanta Working Paper 2009-2 - Could market participants have foreseen the increase in home foreclosures in 2007 and 2008? The authors provide evidence that analysts understood the relationship between house prices and foreclosures but considered a substantial national decline in house prices unlikely.

————

the transformation continues … - Most Credit Swaps Should Be Banned as Gambling, Morelle Says - Dawn Kopecki and Matthew Leising - Bloomberg - Democrat and Chronicle

————

Here We Go Again: S&P Slashes Thousands of RMBS Ratings - Paul Jackson - There’s a saying about death by a thousand paper cuts, and that’s clearly been taking place for most of the private mortgage-backed securities market over the course of the past twelve months. On Monday, Standard & Poor’s Ratings Services lowered the boom — again — on thousands of Alt-A and subprime RMBS, moving them all to a ‘D’ rating, as well as cutting hundreds of formerly AAA-rated securities multiple notches from their previous perch atop the ratings… - housingwire

————

In Case You Hadn’t Noticed. - Vinny Catalano - Here are few items that have been noted on this blog and in Blue Marble Research reports:

The Slow Thaw

3 month LIBOR 1.24

3 month US Treasury rates 0.29%

TED Spread 0.95

NY Fed Commercial Paper Facility: Today 1.24%; Jan. 14 1.16%

At long last, Robert Rubin gets mark-to-market religion*

————

Financial Crisis: The Failure of Accounting Reform - Daily Article by Jesus Huerta de Soto - … Just as “war is too important to be left to the generals,” accounting is too vital for the economy and everyone’s finances to have been left to the experts, whether they be visionary professors, auditors eager to strengthen their position, analysts, (ex-)investment bankers, or any of the manifold international committees. … - mises.org

————

The Stimulus Score Card - Joshua Zumbrun - What $884 billion will and won’t do to goose the economy. - Forbes

=====

IRA ARTMAN SECTION - thanks Ira:

U.S. Housing Slump Has ‘Just Begun,’ Says Forecaster Talbott - Review by James Pressley - … Talbott is an oracle with a track record: His previous books predicted the collapse of both the housing bubble and the tech-stock binge before it. A friend who runs a New York steak house introduces him as Johnny Nostradamus, he says. What sets him apart from other doomsayers is his relentless emphasis on simple arithmetic. … - Bloomberg

————

Recession spreads to more states - Jim Haughey - Reed Construction Data

————

US: Bond bear market, but watch the Fed - Several factors suggest that long-dated Treasury yields could rise substantially further this year: Firstly, we expect business indicators to recover going forward. Secondly, the historically large eco-nomic boost from fiscal policy implies that an unprecedented supply of Treasuries will hit the market in 2009. Finally, risk appetite is historically low at present. - DanskeBank

1 response so far ↓

1 Moishe Alexander // Feb 8, 2009 at 5:03 pm

Anyone have a clue how long the slump will last? Will prices bounce back in the next 5 years? 25?

Leave a Comment