Day Two: Geithner Tightens Transaction Transparency - By DIANA GOLOBAY - … announced a new policy of posting investment contracts for future transactions on the Treasury’s Web site within five to 10 business days. The campaign, which he said will bring accountability to the TARP and allow taxpayers to monitor the terms and agreements of the transactions, has successfully posted the first nine contracts under the Capital Purchase Program and will post the contracts of other completed transactions on a rolling basis. … - housingwire

————

1. Who Will Eat The Cram Downs? - Maurna Desmond - Somebody has to take the hit if bankruptcy judges forgive troubled mortgages. It will probably be you. - Forbes

2. Here Comes The BARF - Liz Moyer - Why creating a Bad Asset Repository Fund for Wall Street’s toxic assets could make banking even sicker. - Forbes

3. Worse Than A Bad Bank - Daniel Indiviglio - Trying to insure troubled assets is even hairier than buying them. But it won’t stop the Treasury from trying. - Forbes

————

Home Sales Jump - … U.S. home sales registered their biggest monthly jump in nearly seven years in December, as cratering prices began to draw out more buyers and several major housing markets showed some signs of stabilizing. … Such behavior is a sign that the bottoming process in housing has begun. … - Toro’s Running of the Bulls

————

Dealing with Foreclosures: Government Chartered Rental Agency? - thanks Liz Coppedge - The Inquisitive Mind

————

1. video and text - How Bernanke’s Policy of ‘Credit Easing’ Works - The Fed now has a three-pronged approach to infusing the financial system with capital - By James Cooper - BusinessWeek

2. video and text - Stimulus: To Spend or Not to Spend? - Economists are engaged in a fiscal feud over Obama’s spending plan and how much of a boost it will give the recession-wracked economy - By Michael Mandel - BusinessWeek

————

good commentary - No sign of ‘weapons of mass inflation’ - Commentary: Bankers, get on track or risk ‘nationalization’ - By Lou Barnes - inman news

————

Freddie Mac to let residents rent homes after foreclosure - USA Today

————

has chart - Top Wholesale Reverse Mortgage Lenders of 2008 - John Yedinak - … Overall, 2008 was a great year for wholesale lenders, with 80% of the top 10 seeing their volume at least double from 2007. This should be an interesting year for wholesalers, with Nutter having problems others are bound to pick up … - Reverse Mortgage Daily

————

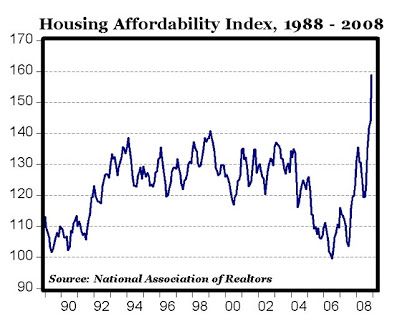

Housing Affordability Surges to Record High in Dec. - Mark Perry - has chart and commentary - Carpe Diem

I like the Freddie Mac article from USA today. It’s a good thing for them to do since a lot of people are losing their homes because of the current state of the economy.