read his plan - How About Adjustable Principal Mortgages Instead? - Alex Trias - Seeking Alpha

————

US Ahead of Europe on Improving RMBS Transparency - CreditSights gives Europe’s securitization industry a D grade in its efforts to improve transparency of new residential mortgage backed securities. In contrast, the US industry gets an A+. - Research Recap

————

Rating Agency Flaws and a Fix - The Law of Unintended Consequences - by John Mauldin - John Mauldin’s Weekly E-Letter

————

NY FRB’s Dudley Certain TALF Will Expand - Reuters - New York FRB President William Dudley (FOMC voter) said today that the new Term Asset-Backed Lending Facility (TALF) will expand to allow the NY Fed to lend funds to financial institutions in return for residential mortgage-backed securities … - Forbes

————

Tranche Warfare: MBS Investor Sues American Home Over REO Sales - By TERI BUHL - A Greenwich-based hedge fund manager is in a desperate fight to keep his subprime MBS investment strategy alive. HousingWire peeled back the layers to uncover what’s really going on behind the scenes in what has become a vicious battle between the hedge fund and legendary investor Wilbur Ross’ mortgage servicing company, Irving, Tex.-based American Home Mortgage Servicing, Inc. - housingwire

————

Ginnie Warehouse Lines Coming? - What We’re Hearing - By Paul Muolo - THIS JUST IN: The Government National Mortgage Association might be open to providing (in some manner) warehouse financing to non-depository mortgage banking firms, helping alleviate the credit crisis in that sector. GNMA isn’t ready to talk about it but there are rumblings out there. - National Mortgage News

————

Scholes Advises ‘Blow Up’ Over-the-Counter Contracts - Christine Harper - Myron Scholes, the Nobel prize- winning economist who helped invent a model for pricing options, said regulators need to “blow up or burn” over-the-counter derivative trading markets to help solve the financial crisis. - Bloomberg

————

Stocks: How Violent Could A Rally Be? - Todd Sullivan - Look at the following charts. The amount of cash sitting and waiting for a home is staggering. When it decides to flow into equities, the upside could be like nothing we have ever seen. - ValuePlays

————

The Biggest Source for Risk: Government - … With the perpetual, arbitrary, ever-shifting bailouts and interference in the market, the government has paralyzed the already-disfunctional financial market machinery. Regulatory and policy risks are scaring a lot of players to the sidelines, and at the same time creating huge arbitrage opportunities that could turn out to be equally lethal traps. … - Derive This Blog

————

Avg. Size New Home Falls for First Time Since ‘94 - Mark Perry - Carpe Diem

————

How Generations Predict the Crisis will last until 2025 - One of the most significant aspects of generational research for me is its predictive ability. The cycle of generations described by Neil Howe and William Strauss in their books (starting with “Generations“) has an amazing predictive ability - The Gen X Files

————

MEGA-AUCTION TO HAMMER IT ‘HOME’- CITY’S BIGGEST-EVER FORECLOSE FIRE SALE - By JAMES FANELLI - It’s New York City’s own version of a mortgage bailout - a massive auction today at the Javits Center where banks hope to unload scores of foreclosed homes, some for 60 percent discounts or more. - NY Post

————

5/3 reviews mortgages for changes - Fifth Third Bancorp review more than 200,000 mortgages for eligibility under the federal government’s Making Home Affordable Program. The Obama administrations says the plan could help up to 9 million households either refinance or modify terms of home loans. - Cincinnati.com

————

witchhunt continues - Should bank executives be allowed to use limos? - MSNBC

————

Bank of America can avoid Citigroup’s fate - Barron’s - … But Bank of America and Citigroup are different, the weekly business newspaper said in its latest edition dated March 9. Citigroup had to convert preferred shares into common stock to boost its capital ratios, a move that will give the U.S. government up to a 36 percent stake in the bank. … - Reuters

Tags: Blogs · Charts & Tables · Economy · GSEs · Mortgage Market · Research & Papers

President Obama said last week that it’s a good time to buy stocks. So this morning, instead of spending $5 on a Grande latte, I used the money to buy 100 shares of GM…

If the taxpayers should pay for their neighbor’s mortgages, should “good” banks pay for the mistakes of other banks? The FDIC insures 8,300 banks and lenders (including Capital One, who cut their dividend by 87%), and they are all facing increased fees and a one-time “emergency” charge designed to raise $27 billion this year for the agency. Small community banks may take a 10-20% hit on their 2009 earnings. In theory, community banks rely more heavily on deposit funding, so they suffer a “much heavier burden” as a result of deposit insurance proportionate to size than banks like Citi or BofA. U.S. Senate Banking Committee Chairman Dodd may introduce legislation that would temporarily raise the FDIC’s $30 billion borrowing authority with the Treasury to $500 billion, with a permanent increase to $100 billion.

“Rep. Tom Price, R-Ga., plans to introduce legislation that would prohibit the use of government funds to modify mortgages for individuals that “lied about their income on their mortgage application.” Price’s measure would also prohibit government funding to any lender that failed to follow proper underwriting standards.” Determining this sounds near-impossible, but you can take a look at this MarkeWatch article.

Chase, given the recent announcement regarding the Homeowner Affordability and Stability Plan and the plan to have servicers possibly modify loans, has established a support unit that is prepared to offer help to those borrowers looking for refinance assistance. If Chase is the servicer of record, the borrower should call (866) 550-5705.

The purchase market, or I should say the interest by investors in purchase loans, is heating up. Some investors are offering price incentives. For example, Union Bank of California, who offers no correspondent channel, is knocking 1/8% off the interest rate on the purchase of a primary residence or vacation home.

Franklin American is revising their credit parameters for FHA Jumbo and Conventional Conforming Fixed Rate loans. These changes are effective for all loans locked from today onward. FHA Jumbo revisions include all cash out refinance transactions must meet a minimum credit score of 680 and must have a second appraisal regardless of property location, the maximum cash out is limited to $100,000, loans utilizing gift funds are ineligible, and the borrower may not have any other financed properties other than the subject property. For their Conventional Conforming Fixed Rate, all Conventional Loan Appraisals dated on and after April 1, 2009 must be accompanied by a completed Form 1004 Market Conditions Addendum (1004MC) for appraisals of one to four unit properties. (FAMC also reminded their customers that they are not following the Fannie guidelines for maximum properties owned, but instead are restricting the total number of properties to 4 including the borrower’s primary residence.)

For the week ending March 4th, the Federal Reserve Bank of New York bought $30 billion in mortgage-backed securities. (They’ve bought a total of $190 billion so far.) What are the coupons? 4.5’s and 4.0’s accounted for 77% of the net purchases. If buying $30 billion in 5 days, when new production is about $2 billion a day, won’t help mortgage prices, I don’t know what will!

This week is light in terms of economic news. In fact, there is little until March 11th, when we see the usually-ordinary Treasury Budget. (This has taken on a little more significance as of late…) Thursday we have Jobless Claims, Retail Sales, and Business Inventories, and then on Friday the 13th we have the Trade Balance figures for January along the preliminary Michigan Consumer Sentiment Survey (is there much to be optimistic about in Michigan right now, aside from Spring being on the way?). Of no little importance is an auction this week, starting tomorrow with $34 billion of 3-yr notes, $17 billion of 10-yr notes on Wednesday, and $11 billion of 30-yr bonds on Thursday. Nonetheless, the markets are roiled this morning since HSBC’s stock taking a 24% plunge is once again pushing our own equity markets down, and we find the 10-yr at 2.86% and mortgage security prices roughly unchanged from Friday afternoon.

A cowboy, who is visiting Idaho from Texas , walks into a bar and orders three mugs of Bud. He sits in the back of the room, drinking a sip out of each one in turn. When he finishes them, he comes back to the bar and orders three more.

The bartender approaches and tells the cowboy, “You know, a mug goes flat after I draw it. It would taste better if you bought one at a time.”

The cowboy replies, “Well, you see, I have two brothers. One is in Arizona the other is in Colorado . When we all left our home in Texas we promised that we’d drink this way to remember the days when we drank together. So I’m drinking one beer for each of my brothers and one for myself.” The bartender admits that this is a nice custom, and leaves it there.

The cowboy becomes a regular in the bar, and always drinks the same way. He orders three mugs and drinks them in turn.

One day, he comes in and only orders two mugs. All the regulars take notice and fall silent. When he comes back to the bar for the second round, the bartender says, “I don’t want to intrude on your grief, but I wanted to offer my condolences on your loss.”

The cowboy looks quite puzzled for a moment, then a light dawns in his eyes and he laughs.

“Oh, no, everybody’s just fine,” he explains, “It’s just that my wife and I joined the Mormon Church and I had to quit drinking.”

“Hasn’t affected my brothers though.”

Rob

(For archived commentaries, check www.robchrisman.com, or to subscribe write to [email protected])

Tags: Commentary · Mortgage Market · Rob Chrisman

Marilyn Monroe as Lorelei Lee in 1953 publicity photo © 1953 20th Century-Fox Film Corporation,

for Gentlemen Prefer Blondes, from The Trouble With Marilyn Blog/Louie Gee.

All are humbled and floored by the backside of the boom. We are now told that gentlemen – and ladies – should prefer bland.

We should prefer bland:

Mortgage Loans

- Fully amortizing fixed rate rather than interest-only neg am ARMs;

- Full documentation rather than stated aspirations;

- Conforming vanilla rather than a spicy subprime jumbo;

- 20% down rather than a fling and a prayer; and

- Unencumbered first liens rather than the deceitful silence of seconds.

Securitizations and Credit Enhancement

- Government guaranteed or backstopped Ginnies, Fannies, and Freddies rather than private label issues with accounts spread wide;

- Simple pass-throughs rather than multi-class Collaterally Damaged Securities;

- Committed issuer “skin-in-the game” rather than casually flippant gain-on-sale; and

- A plain understanding of the underlying risk, rather than an issuer-funded alphabet jungle.

Bank Business Models and Capital Structure

- Transparently vertical businesses rather than an opaque horizontal sprawl;

- Old-school “rules-of-thumb” rather than a toothy Basel concoction; and

- Simple common rather than a bubbling brew of cumulative, convertible, putable, or participating preferreds.

The most destructive of the above is the last – a recently acquired DIStaste for preferred stock, and the corrosive reliance upon common.

It is destructive because it:

- Diverts our attention away from those who twice-lanced bank capital structures – first in September of ‘08; and again in March of ’09; and

- Completely disincents private investors from reviving the wounded banking beast, which will now be bled dry.

We will now examine “preferred stock” in much greater detail, by:

- Defining preferred stock;

- Describing how federal agencies blessed banks’ swelling use of preferred. This allowed preferred to grow from nothing to almost half of all bank capital; and

- Conducting an “event study” of preferred’s trading price and yield, as federal bailouts destroyed the private preferred stock market and any hope for a revitalized privately-owned banking industry.

Preferred Stock

Let’s begin with a definition. “Preferred Stock” is:

- Capital stock that provides a specific dividend that is paid before any dividends are paid to common stock holders. It takes precedence over common stock in the event of liquidation.

- Preferred stocks represent partial ownership in a company, but preferred stock shareholders do not enjoy any of the common stockholders’ voting rights.

- Preferred stocks pay a non-fluctuating fixed dividend, although the company may not pay this if it lacks the financial ability to do so.

- Preferred shareholders always receive their dividends first and, in bankruptcy, preferred shareholders are paid off before common stockholders.

Source: Investorwords.com: Preferred Stock

Bank Use Of Preferred Stock

Now let’s look at regulators’ attitudes toward banks’ use of preferred stock as capital.

As Mark Sunshine of First Capital observed in Tangible Common Equity – How Much Is Enough?:

- Banking regulators started focusing on the low level of “Tangible Common Equity” [TCE] at large banks … after Tim Geithner became Treasury Secretary.

- Adequacy of TCE is measured by the TCE ratio, which is the amount of TCE divided by amount of tangible assets. Better-capitalized banks have higher TCE ratios and have lower risk of failure than banks with lower ratios.

- TCE is different than common equity because TCE is reduced by the amount of a bank’s intangible assets.

- Intangible assets are things like goodwill [at one time the byproduct of federally-approved bank mergers] and tax benefits from net operating loss carry forwards. These assets don’t produce income and don’t have a cash equivalent value. Moreover, intangible assets can’t support banking operations or cover losses.

- Even worse, intangible assets have a child-like “pretend” quality to them; one minute everyone pretends intangible assets are there and then the next minute reality sets in and they disappear.

The following table takes a look, over time, at the composition of banks’ capital structure. It is based on the capital structure of nine large US banks.

Mark Sunshine graciously provided me with the bank capital ratio data that I used to create Figure 1. Thank you, Mark, and your helpful investment bank friends. As Mark has noted on his website – Sunshine Notes - the list of banks doesn’t claim to be a scientific or random sample.

Figure 1: Tangible Equity, Tangible Common, and Preferred Stock, 1995 and 2008.

Source: SNL Financial, author’s calculations.

We see from Figure 1 that:

- Between 1995 and 2008, the tangible equity/tangible asset ratio of the sampled banks was relatively unchanged, dropping slightly from 6.4% to 5.4%;

- This modest decline in the “tangible equity” ratio masked a much larger decline in the tangible common equity/tangible asset ratio, which plunged from 6.3% to 2.7%;

- This dive in the “tangible common equity” ratio reflected a surge in the sampled banks’ use of preferred stock;

- In 1995, preferred stock represented a negligible amount of the banks’ capital structure; and

- By 2008, however, just before Secretary Geithner became Treasury Secretary, and regulators “started focusing on the low level of TCE”, preferred stock represented virtually half of the sampled banks’ capital.

Given the reliance upon preferred by 2008, it’s clear that regulators’ sudden distaste for preferred (which is excluded - by definition - from TCE) is a significant policy change.

It is at least as significant as, and resembles, regulators’ repudiation of supervisory goodwill during the S&L crisis of the 1980’s, which produced waves of S&L failures.

Supervisory goodwill was an intangible asset created when sound S&L’s acquired, and paid more than book value for, failing institutions. These transactions were instigated and blessed by the government – in much the same way that Bank of America acquired Merrill Lynch in 2008.

At the conclusion of the S&L debacle, the former FDIC Chairman said:

- I made a commitment . . . and the government breached it and I find that very offensive . . .

- I made a promise . . . that we would count goodwill as part of capital for [many] … years. It was a very conscious decision on our part… I don’t think anyone after me had the right to turn their backs on that.

- If you can’t count on the government to live up to its word, then the FDIC is never going to be able to do business with people in the future.

William Isaac, Former Chairman FDIC , Source: MeritorPSFS.com, Supervisory Goodwill - A National Scandal

Note: For additional background on supervisory goodwill, and the similarities between today’s crisis and the S&L crisis, see my “Thing One & Thing Two – Supervisory Goodwill and TARP” of 19 Jan 2009.

It should be emphasized that US banking regulators had not objected to (and had encouraged) banks’ increased use of preferred stock as capital.

The Basel II international bank capital standards blessed preferred stock, and a variety of US banking and thrift agencies helped construct the Basel rules. These included the:

- Board of Governors of the Federal Reserve System;

- Federal Deposit Insurance Corporation;

- Office of the Comptroller of the Currency, and

- Office of Thrift Supervision.

The federally blessed rules, which had been in the works for many years, finally took effect in April of 2008.

Let’s now turn our attention to a readily accessible measure of financial preferred stock performance, so that we can tie the destruction of the preferred market to government “bailout” activity.

Our Benchmark - Financial Preferred ETF [PGF]

Rather than focus upon the preferred stock of any particular financial firm, we’ll look at the performance of a representative basket of preferred stocks. Specifically, the performance of an exchange-traded-fund (or ETF) that invests in preferred stocks issued by financial firms.

That ETF is the Powershares Financial Preferred Portfolio with symbol PGF. Websites began to track it in early 2007, about 6 months before the subprime unpleasantness began. Note: I do NOT own any shares of PGF.

Below is a snapshot of the “top 10” PGF holdings (i.e., roughly one-third) at year-end 2008:

Figure 2: PGF Top 10 Holdings, Year End 2008. Source: Invescopowershares.com

The “coupon” in Figure 2 refers to the “non-fluctuating fixed dividend” referenced above. Dividend yields of the year-end ’08 “Top 10” holdings were in the 8% range, when the preferred stocks in the ETF were originally issued [more about historical and current yields below!].

PGF Price History and Relationships

Below is a quick recap of PGF’s weekly trading price, since January 2007:

Figure 3: PGF share price Since January 2007. Source: Yahoo! Finance.

As the chart indicates, PGF’s price was virtually unchanged for the first half of 2007, and lost less than $3 by mid-October 2007 – three months after jumbo mortgage products spreads blew out in July.

As the following charts (see Figure 4, below) indicate, PGF’s price movements, in the first half of 2007, were more closely related to bond prices than they were to those of financial stocks. During this period, preferred stock was a relatively cheap form of bank capital, with costs – and coupons – similar to “straight debt.”

Figure 4: PGF Price Scatterplots, Jan 2007 – June 2007.

Top – Scatterplot of PGF and Financial Stock Prices (ETF: XLF)

Bot – Scatterplot of PGF and Corporate Bond Prices (ETF: LQD)

Data: Yahoo! Finance. Note: Prices adjusted to reflect dividend distributions. [Yahoo! is source for all subsequent data.]

As the top chart in Figure 4 indicates, there was NO relation between the price of PGF and financial stocks (measured by the XLF Financial SPDR) in early ‘07. Indeed, the bottom chart (which plots PGF prices against those of the corporate bond ETF, LQD), indicates that PGF prices tended to track those of corporate bond prices in the first half of ‘07.

These relationships broke down in the summer of 2007, when the non-conforming mortgage market collapsed.

Preferred stock prices began to more closely follow the prices of financial STOCKS (See Figure 5), rather than the prices of corporate, coupon-paying BONDS (bond chart NOT shown).

Figure 5: PGF Price Scatterplot, July 2007 – Dec 2007.

Scatterplot of PGF and Financial Stock Prices (ETF: XLF)

PGF Yield History and Relationships

As PGF’s price fell, PGF’s yield rose, from 5.5% at the beginning of 2007 to 7.0% by year-end 2007. Figure 6 charts PGF’s yield, from 2007 until today.

Figure 6: PGF Yield, January 2007 – March 2009.

PGF’s yield continued to rise as 2007 ended, but did not move up that sharply when JPMorgan acquired Bear in the spring of 2008. This is because JPMorgan converted Bear ‘s outstanding preferred into “substantially identical” JPMorgan obligations, and preferred investors were relatively unaffected.

GSE Conservatorship – September 2008

This was not the case when Fannie and Freddie (the “GSE’s”) were placed into conservatorship in early Sep 2008 [See Figure 6, above].

Government investments in the GSE’s came in the form of a new class of government-owned preferred stock that extinguished the value of the existing GSE preferreds. This created unanticipated problems for other banks that had invested in the GSE preferreds:

- “When the FHFA placed Fannie and Freddie in conservatorship, the payment of dividends on preferred stock was eliminated. At the time, federal banking regulators estimated that only a few dozen banks would be affected.

- However, the ABA survey shows that the number of banks affected is considerably larger.

- ‘The negative impact on banks … is far greater than the regulators first thought,’ [the ABA] said…”

Source: Tim McLaughlin , Boston Business Journal, Mass. banks hit hardest by Fannie, Freddie preferred, 23 Sep 2008 [emphasis added].

GSE conservatorship had an immediate and continuing impact upon bank capital positions.

Bloomberg described the immediate impact on 8 Sep 2008:

- “While the preferreds aren’t being formally wiped out, their value is largely gone,” … analyst Sean Ryan said yesterday. The takeover has “pretty ugly implications for capital adequacy” for some lenders, he said.

- Some smaller lenders that bought preferred stock …have holdings valued at a significant percentage of their capital. Banks that don’t maintain minimum capital levels against losses may … in some cases be shut down.

Source: Linda Shen, Bloomberg - Lenders With `Outsized’ GSE Stakes May Need Capital, 8 Sep 2008, [emphasis added]

The resulting rise in preferred yields prevented financial institutions from economically raising additional capital via new preferred issues. After the government boosted its equity stake in Citigroup in March 2009, Reuters reported:

- [The] … decision to halt dividend payments on some of its preferred shares may be the final blow for certain bank preferred stocks and may further dry up the willingness of private investors to buy other bank securities…

- A BNP Paribas analyst said that “investors will be concerned that the government may intervene in other banks… which have borrowed from TARP, and this will have a similarly negative impact on these types of preferred shares,” he said.

- Standard & Poor’s said in a statement that “…We are … concerned that [this] … could mark a tipping point for the financial institutions sector…”

- …As investors take fresh losses on bank securities, financial companies are increasingly at the mercy of government programs for their funding.

Source: Karen Brettell, Reuters - Citi dividend decision watershed event, 4 Mar 2009, [emphasis added].

By 6 Mar 2009, yields on financial preferreds topped 20%. The preferred market cannot provide banks with any additional capital. As a result of “bailout” efforts, preferreds trades like, and are as expensive as, common equity.

Floored Again

Economists use the term “crowding out” to refer to:

- Reductions in private consumption or investment that occur because of an increase in government spending.

Source: Wikipedia.com - Crowding Out (Economics).

As typically described, government spending “crowds out”:

- Private spending if it is financed by a tax increase, which tends to reduce private consumption; or

- Private investment if it is financed by increased government borrowing, which eventually increases interest rates, and leads to a reduction in private investment.

The ’08 and ’09 “bailouts” of Fannie, Freddie and Citigroup are a new manifestation of “crowding out” unanticipated by the conventional theory.

In this instance, the government has “crowded out” and eliminated the possibility of any future private investments in financial preferreds by its destruction of the pre-existing preferred market.

Having spoiled the stream with its own, the government has the chutzpah to warn that we should not to drink the water. “Forget ‘tangible equity,’ which includes preferred stock – focus your attention upon ‘tangible common equity’, or TCE.”

Prior to the “wipeout” of the GSE preferred in Sep 2008, James Grant of Grant’s Interest Rate Observer was asked:

- What would be the alternative to preserving the value of GSE preferreds?

- His answer – we should get down on our knees and pray.

Source: John Dizard, The Financial Times - A measured view of GSE preferreds, 31 Aug 2008.

Excuse me, Marilyn, I don’t mean to crowd you - but I need to get down on the floor.

- - - - - - - - - - -

I used to work with numbers for a living. These days I keep thinking about when we’ll find the bottom as I search for a new job or at least my next idea. Till next time.

REFERENCES

Susan Kulakowski, Credit Analyst & Presenter, FairIsaac InterACT 09/Analytical Innovation: What’s Next for ABS - Where does MortgageLand go from here?, 10 – 13 Mar 2009 [upcoming].

Mark Sunshine, First Capital/Sunshine Notes - Tangible Common Equity – How Much Is Enough?, 4 Mar 2009.

Tags: Commentary · Ira Artman · Mortgage Market

1. big article - When There’s Nowhere Left to Spread the Risk - As policymakers and investors deal with bursting asset bubbles and other problems, old notions of investment risk have gone by the boards - By David Wyss - BusinessWeek

2. Did Obama Cause the Stock Slide? - By Ben Steverman - Wall Street has soured on the new Administration’s policy moves. Can this relationship be saved? - BusinessWeek

————

1. Barney Frank Seeks Prosecutions for Those Involved in Downturn - House Financial Services Committee chairman to push for civil, criminal statutes to make bad practices illegal, but avoids addressing his own role in downturn. - By Jeff Poor - Business & Media Institute

2. Two banks to return U.S. bailout money: Rep Frank - … Northern Trust and US Bank … (comments from BC - Barney blasted NT on their golf outing - NT never needed the funds and only took the funds after arm twisting by the Treasury.) - Reuters

————

Mortgage ‘Cram-Down’ Bankruptcy Bill May Aid 1 Million in U.S. - By Dawn Kopecki - At least 1 million Americans would be able to use bankruptcy to reduce mortgage payments under legislation approved by the House yesterday, part of Democratic efforts to stem a crisis that has erased more than $2.4 trillion in home values. … The measure, which passed the House 234-191, now goes to the Senate. … - Bloomberg

————

Private Sector Solutions to the Mortgage Crisis - By Jeff Korzenik - Bloomberg carried an interesting story yesterday about a private firm taking advantage of an arbitrage opportunity in the mortgage market. The firm, NewOak Capital, purchased an underwater mortgage (loan exceeded the value of the home) from a lender at a substantial discount. NewOak was able to pay down the principal enough to refinance into a conforming loan and still make a profit. - (in)efficient frontiers blog

————

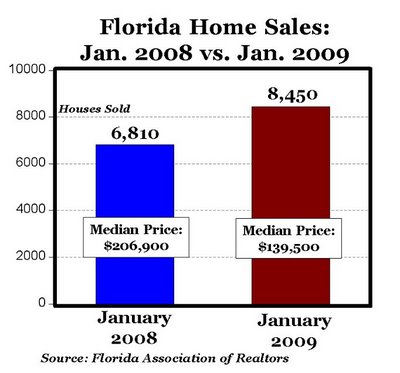

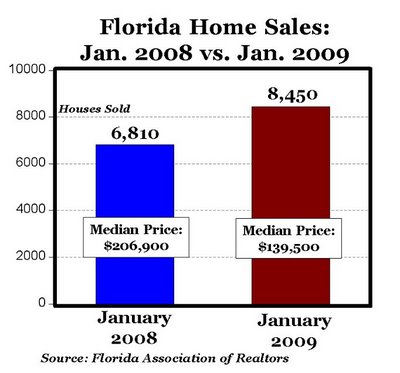

interesting chart - Florida Home Sales Increase for 5th Month in a Row - Mark Perry - Carpe Diem

————

has video and comments - Why Felix Should Walk Away - “Felix” means lucky, in Latin. But this Felix hasn’t had much luck: after investing a whopping 50% downpayment into his $600,000 California dream home, he’s seen the value of his house fall to $270,000, even as the amount outstanding on his mortgage has ballooned to $350,000, putting him among the 8.3 million Americans with negative equity. This is what CNBC calls a “Dollar Dilemma” … - by Felix Salmon - portfolio.com

————

Why the TALF Is Bad for America - Chris Ciovacco - The recent … (TALF) announcements bring to mind Einstein’s definition of insanity – “doing the same things over and over again and expecting different results”. It is well documented that securitization of loans, use of leverage, and government intervention in the free markets helped inflate assets bubbles, fostered a culture of debt, and distorted the efficient allocation of limited resources in our economy. - Ciovacco Capital Management

————

Call This A Cure For A Crisis? - Susan Lee - The government’s economic remedies merely reconstitute the problems. - Forbes

————

SPARE THE WEALTH - MAYOR: RICH TAX WOULD SOCK THE POOR - By DAVID SEIFMAN - Mayor Bloomberg warned yesterday that proposals to tax the rich will backfire and end up hurting the poor whom they are intended to help. - NY Post

————

House Trap - Upside-Down Owners Missed by Rescue - By Michael S. Rosenwald - When houses on our block sell for $50,000 less than we paid for ours — if they even sell at all — I get queasy. … We are upside down, in an interest-only loan that will reset next year, and we are petrified. … We qualify for neither. We won’t get a refinancing under the program because my loan was sold off to investors and is not backed by Fannie or Freddie. We’re not eligible for a modification because we are still able to make payments, even though we fear the worst next year. … - Washington Post

————

A Waiting Game for Refinancing - BOB TEDESCHI - … The waiting game is particularly risky for homeowners in areas where property values are dropping sharply, and for those with barely above 20 percent equity in a home — the typical minimum for qualifying for any home loan. … Ms. Garlin said it used to take four to six weeks to complete a purchase mortgage, and three to four weeks for a refinance mortgage. Now, she said, a refinance can take as long as six weeks, and a purchase mortgage can take as long as two months. … - NY Times

————

Reverse Mortgage Limits Rise, Values Fall - John Yedinak - Seemingly headed in opposite directions, the HECM loan limit has risen just as home values are falling. The new HECM limit is $625,500 (only for this calendar year) – representing 150 percent of the GSE (Fannie Mae/Freddie Mac) forward mortgage conforming ceiling. - Reverse Mortgage Daily

————

US Banks’ Willingness to Lend May Not Improve This Year - Fitch Ratings says a survey of senior fixed income investors finds that banks’ reluctance to lend is seen as the highest risk to the credit markets over the next 12 months. What’s more, nearly 40% of respondents don’t expect banks’ willingness to lend to stabilize this year. - Research Recap

Tags: Blogs · Charts & Tables · Economy · Government · Mortgage Market · Research & Papers

Reverse Mortgages for Purchases May Be Difficult to Manage - A highly anticipated nod from HUD allowing use of reverse mortgage funds to buy homes (a.k.a. “HECM for purchase”) and co-op apartments would mean more business for players in the sector. “It will really open up opportunities for lenders, specifically in areas such as New York and Chicago where there are so many co-ops,” says …- Reverse Mortgage Daily

————

Geithner Warns of Deeper Slump, Seeking Backing for Bank Rescue - By Steve Matthews and Scott Lanman - Bloomberg

————

Massive Cuts Required to Restore Investment Bank Returns - … In a free white paper “The Next Generation Investment Bank,” BCG gives its view on what investment banks must do to restore profit margins over time in the post-credit-crisis financial landscape. A complete overhaul of the business model is required, according to BCG. One thing is clear from the report - investment banks still have a lot more cost-cutting to do … - Research Recap

————

has individual examples - Homeowners Size Up Housing-Aid Plan - Mortgage-Assistance Program Offers Disparate Treatment Depending on Goals and Circumstances - NICK TIMIRAOS - Wall Street Journal

————

1. lots of charts - China – better days ahead? - Posted by Prieur du Plessis - The improved Chinese PMI numbers, together with the additional stimulus package, probably mark a trough in the GDP growth cycle. Will the Chinese command economy come to the rescue of the Western world? Time will tell, but there are rays of light, not least of which is a bullish-looking Chinese stock market. - Investment Postcards from Cape Town

2. 24 Financial Videos of the week - Prieur du Plessis’ weekly collection - worth checking - Investment Postcards from Cape Town

————

1. Home Prices: CA vs. SD, TX, OK, MO, AL and AR - Mark Perry - Carpe Diem Blog

2. Geography of the Recession - Mark Perry - Carpe Diem Blog

————

Schapiro prepares to address rules for credit-rating agencies - Zachary A. Goldfarb - The Securities and Exchange Commission plans to hold a roundtable discussion on a proposed overhaul of regulations governing credit-rating agencies. The move, which is set to be announced today, would be the first public-policy initiative undertaken by Chairwoman Mary L. Schapiro. The discussion is scheduled for April 15. - The Washington Post

————

READ THIS - abuse ahead? - Government’s new 5-year ARM at 2 percent - Tim Iacono - Details of the Treasury Department’s Homeowner Affordability and Stability Plan were announced today. It’s quite an interesting undertaking that seems like it will be good fun for at least the next couple years as stories of abuse and odd goings-on come to light. - TheMessThatGreenspanMade

————

A Look at Homeowner Vacancy Rates - Rather than participate in the usual analysis of housing prices and home sales data, I decided to get down to Brass Tax and look at homeowner vacancy data … has commentary too - Analytical Wealth Blog

————

Freddie Mac Rolls out REO Rentals, Halts Evictions Again - By PAUL JACKSON - Get ready for eviction volumes to start decreasing, at least in the short run. And perhaps it’s time to start asking exactly when does a rental property ever become a owner-occupied resale? - housingwire

————

Scam Primer - Board has compiled some tips to help protect consumers from foreclosure scams - Released by the Board of Governors of the Federal Reserve System

————

PennyMac, Mortgage-Servicing Hero - Felix Salmon - I’m heartened by the content of Eric Lipton’s NYT story on PennyMac, even as I’m disappointed in its tone. PennyMac is a company set up by former Countrywide executives — people who understand the mortgages which are souring around the nation. It is dedicated to buying up and servicing those mortgages in the most effective manner: reducing interest rates, working with borrowers, and not foreclosing. - portfolio.com

————

In the wacky world of mark-to-market accounting, a bank can be well-capitalized and insolvent at the same time. How’s that for “transparency”? Gary Townsend explains at bankstocks.com

————

HENRYs: Hey, Mr. President: Who You Calling Rich? - By Stephen P. Diamond, Jr. - Last week, millions of Americans were surprised to discover that they are rich. Well, not really. But under President Obama’s proposed budget, many taxpayers earning more than $200,000 a year ($250,000 for married couples) and less than $500,000 have suddenly found themselves lumped together with the likes of Stephen Schwarzman and Donald Trump, ... Fortune magazine’s Shawn Tully has called these people “HENRYs” –aka “high earners, not rich yet.” They are doctors, lawyers, consultants, managers and small business owners who have prospered in recent years … - FoxForum Blog

Tags: Blogs · Charts & Tables · Economy · Government · Mortgage Market · Securitization

To Our Clients, Colleagues and Friends,

- We’re told by many Bank of America employees that they have been directed to refer to their bank as Bank of America. Not the Bank of America and not BofA or the BofA. Turns out the fellow from the Indy Mac Bank was right when he wrote us about incorrectly putting the word the at the beginning.

- We always loved Hemingway’s definition of courage: “Grace under pressure.” Doesn’t that say it all?

- For our New York clients, how about that line from some unknown commentator: They say that living in California adds ten years to your life; and I’d like to spend those ten years in New York.

- We get asked from time to time where someone can go to get financing for investment properties. For those who keep getting shut out at the banks, we can suggest CalCap Financial. They’re offering private No Income, Verified Assets financing, and while the LTVs are fairly low, they have some borrower-friendly features. We know the people at CalCap, and they’re a smart crew. And we’ve always loved the income property niche. In the old days, almost every mortgage banker had an income property division.

- If you’re located in California , be prepared to order new business cards for everyone. Starting on July 1st of this year, all originators have to start displaying their D.R.E. license number of letterheads and business cards. Thank you Pam Strickland for reminding everyone about this.

- With only 2.76% tangible equity at Wells Fargo, isn’t that awfully low?

- We were just reading an analyst’s report on PHH, a company you almost never hear of. They’re doing about $2.5 billion a month with a gain on sale margin around 115 bps. They book their gains on rate lock commitments rather than loan sales. And yes, this is acceptable under GAAP as long as you get your pull-through estimates and a few other assumptions correct.

- We were at Crestline Funding a few days ago down in Orange County , and an interesting thing happened. At the end of the day, it occurred to us that we hadn’t heard the word “volume” more than once or twice. We’d say their obsession and healthy paranoia about loan quality explain a big part of their success.

- You’ve heard how the big banks are subject to a Stress Test by the U.S. Treasury, right? Well, get this: The so-called Adverse Scenario assumes that home prices fall 22% in 2009, and another 7% in 2010. This would be scary!

- For some reason, baseball players have much funnier or more colorful names than athletes in any other sport. Maybe our all time favorite is one-time Brooklyn Dodger Van Lingle Mungo. It makes us smile just looking at his name. A few others: Tim Spooneybarger, Rusty Kuntz, J.J. Putz, Coco Crisp, ex-Anaheim Angel Dick Wants (whose career lasted all of two innings), Dick Pole, Howard Johnson, and Milton Bradley. Even baseball executive Buzzy Bavasi. The funny thing is that baseball is the worst sport to have an unusual name in. Players spend 50% of their time sitting in the dugout without a whole lot going on – and a whole lot of free time in which to make fun of each other. We can only imagine what life was like for the guy above with the first name Rusty.

- M.I. companies insure against loss, but not loss due to fraud. Bummer, right? Well, The Prieston Group is an insurer which insures against fraud! Cool! We think you should check them out. Call Justin Vedder there.

* *

Joe Garrett and Corky Watts - Garrett, Watts & Co. - 510-469-8633

“Helping mortgage lenders increase revenues, control costs, and better manage risk.”

Tags: Commentary · Garrett Watts · Mortgage Market