To Our Clients, Colleagues and Friends,

- If you look at the November 26 FDIC Press release, you’ll find sixteen new Consent Orders, nine Removal and Prohibition Orders, two Orders Pursuant to Cross Guarantee Liabilities, eighteen Civil Money Penalties and nine Terminations of Orders. That’s 45 bad orders and nine good ones for a 5-to-1 ratio. We need to come up with a clever name (like the Texas Ratio) that uses this ratio as a measurement of bank health and regulatory toughness. Maybe the Bair Ratio, for Sheila Bair. Then people can go around and say, “Wow, the Bair Ratio has dropped three months in a row…” or “Have you noticed the Bair ratio has really been climbing?” In late 2012 and 2013, it should be dropping closer to 1-to-1.

- How about Oregon ’s Quack Attack? The Ducks’ offense is unrelentingly in-your-face. When they scored a touchdown against Cal very early in the first quarter, they went for and got a two point conversion, something you rarely see. Against Arizona , with a huge lead and two seconds left in the game, they didn’t take a knee. Instead, they ran the ball and got 45 yards and almost scored again. Oregon has the most exciting offense I’ve ever seen, in college or the NFL.

- How about prohibiting note modifications for any loan that was a cash-out refinance? Let’s look at two borrowers: (a) Borrower Barbie bought a home in 2006 at the height of the market. She keeps her original mortgage, but the loan balance is much larger than the home is worth. (b) Borrower Bernice bought her house 10-15 years ago and is also upside down. But let’s not shed any tears for Bernice, as she withdrew all her equity with a cash-out refinance when housing values were soaring a few years ago.

There might be a valid argument to modify Barbie’s note. But is there any legitimate reason to bail out Bernice? We conducted a very unscientific poll of four bankers, three mortgage bankers, the mailman and an Orange County taxi driver. They were split about fifty-fifty on Barbie. Not one thought Bernice should get any relief. The mailman put it best. “She can’t have her cake and eat it, too. “

- The taxi driver actually had a great deal to say about note modifications and was quite animated in his views. Unfortunately, he was from some country other than America , and I couldn’t understand a single word he said.

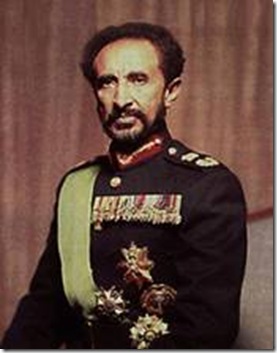

- Speaking of taxi drivers, many Ethiopians come to America to seek freedom, democracy and the right to drive a taxi, and if your cab driver is African and has a strong accent, the odds are good that he’s from Ethiopia . Ask him if he is, and if he says yes, ask him to tell you about Ethiopia ’s former emperor, Haille Selassie, and ask why the Jamaican people think he was God. They love to tell the story:

Back in the fifties, Jamaica was suffering from a horrible drought. It hadn’t rained in two years, and people were getting desperate. During the drought, Selassie flew from Ethiopia to New York to address the U.N., and his plane stopped in Jamaica to refuel. Government officials and the press were there to greet him, and when he stepped off the plane and onto the top step, he raised both arms to wave to the crowd, and, with perfect timing, it started to rain. In fact, it started to pour.

People saw this as a miracle and asked him if he was God, and being a clever politician, he would say things like “I cannot comment on that” or “I cannot deny it.” To add to his aura, he declared himself “The Lion of Judah” and said he was a direct descendent of King David, which, when you think about it, means that he was actually Jewish.

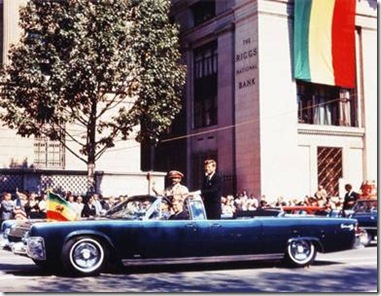

Here’s a photo of him and President Kennedy, and while it’s a distant shot, you can get an idea of what a snazzy uniform he wore. You should really Google his picture. He was strikingly handsome, and no one looked better in royal garb.

Can you see the name of the bank in the background? Riggs National Bank was a very prestigious bank in the D.C. area but got in trouble for laundering money for foreign embassies a few years ago and no longer exists. Anyway, if you go to Jamaica , or even to Jamaican-owned stores, you’ll often see photos of Selassie hanging on the wall. Rastafarians (i.e. Bob Marley-types) believe that worshipping Selassie requires that they grow dreadlocks and smoke lots of marijuana, but how they came up with that is a complete mystery.

- Okay, back to business. Most banks are highly liquid and rebuilding capital, and at some point, we think this will translate into sizeable stock buybacks and fat dividends. Don’t you think this is a great time to be buying bank stocks?

- I recently wrote a book about raising a daughter, and online sales really took off last week, as in through the roof! My book is called Letters to My Daughter (www.AmherstPress18Lettters.com) and President Obama just wrote a book called Letters to my Daughters(plural). Is that an amazing coincidence, or what? What a stroke of luck! I’ll have to write Obama and thank him for boosting sales.

- A new just-found quote from Mark Twain’s just-released autobiography on his days in San Francisco : “The thermometer stays at about seventy degrees the year round. It is no colder and no warmer in the one month than the other.” This isn't entirely true. We do get down into the fifties in winter and occasionally into the high seventies in summer, although both are rare. People often hate us for our weather.

- Rich Walton from RPM Mortgage updated everyone at our recent Client Dinner, and what a success this company is. RPM closed over $500 million in November, has already grown their servicing portfolio to $1.0 billion (they started in April), and earlier in the year bought a commercial bank.

Owner Rob Hirt was not an overnight success. He built his company slowly, cautiously and methodically, one step at a time, and boy, has it paid off. As Rob tells everyone: “Our secret: Great people.” - We had dinner with Joe Meehan at the MBA in Atlanta recently. Folks may remember Joe as the hardworking, battle-hardened National Credit Manager for Wamu and GMAC Bank's warehouse lending units. Joe's now responsible for counterparty risk management with Essent Guaranty, a new MI company that is targeting new business based on its strength of $600 million in capital and no legacy portfolio. Essent has made great progress during its first year and is open for business. Contact him at joseph.meehan@essent.us for more information.

- I was at a mortgage banking company awhile back where I saw 3-4 women with big ace bandages wrapped around their forearms. At first, I thought maybe they’d all been burn victims, but when I asked, it turned out that they all had tattoos, and the company didn’t allow them to be visible at work. Hooray for management there. Young women (and men) need to learn that their desire to look ridiculous will one day clash with their desire to find a job.

- Everyone thinks the Simpson-Bowles Commission on the Deficit was too radical in its recommendations, but let’s look at their plan for Social Security. They propose raising the full retirement age from 66 to 69 by 2075. By 2075?? That’s not radical; that’s just gutless. We have a better idea. Starting in 2013, move the age back one month every year. In 2013 it will be 66 + 1 month, in 2014 it will be 66 + 2 months, in 2014 it will be 66 + 3 months and so on.

Even though AARP will scream bloody murder, it’s simple, it’s easy, and it’s fair. You could do the same thing with Medicare.

Here’s FDR signing the Social Security Act into law in 1935. See the two guys in dark suits? Makes you wonder if maybe the other cabinet members didn’t like these two and told them “Hey, the President and the rest of us are all wearing dark suits, so be sure to wear one.” I count eight cabinet members plus the President all in light suits.

- Boards of Directors typically do an annual review of management, often conducted by the Compensation Committee, and many Boards have each Director evaluate every other Director. What about having management (the CEO, CFO, 2-3 others) do an evaluation of the Board? How helpful are they? Do they help or hurt your relationship with your regulators and shareholders? It’s just a thought.

- I just rented and watched American Teen, a documentary that follows four small-town high school students throughout their senior year. I’ve always enjoyed movies about the high school experience (Ferris Bueller’s Day off, Orange County etc.) and it just occurred to me why! I didn’t have the high school experience that everyone has such strong memories of. Implausible as it sounds, I went to an all boys trade school! It was in a really crummy neighborhood of San Francisco , and it was tiny, with only 51 of us in the graduating class. At least with all boys’ parochial schools, there’s always a nearby girls parochial school they can have dances with. But a girls trade school we could have dances with? Laughably, no.

- The French philosopher Jacque Barzun once wrote, “To understand America , you must understand the high school experience.” American Teen seems to do a pretty good job of showing what it’s really like, with, unfortunately, a little too much Mean Girls in the mix. And some really bad acne. It’s probably worth renting.

- Heard from a mortgage banker the other day: “This Dodd-Frank bill seems really punitive to mortgage bankers. It seems like we’re going to be almost as regulated as the banks, but without the benefits of being one.” Heard from a bank CEO today. ”This is the worst job in the world, period.” When I suggested that when things are going well, it’s also the best job in the world, he told me “Yeah, but it’s still a lousy trade.”

- Did you know that on This Day in History, A Streetcar Named Desire made its Broadway debut, December 1, 1947? The play and subsequent movie made a star out of Marlon Brando, made sweaty undershirts acceptable, and popularized the line, “I have always depended on the kindness of strangers.”

* *

Happy holidays, and may all of you get a CAMELS-1 next year.

Helping lenders increase revenues, control costs, and better manage risk.

- Mike McAuley (281-250-2536)

- Joe Garrett (510-469-8633)

- Corky Watts (408-395-5504)

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment