The California and Florida housing markets are as

different as black and white.

That’s the

view of real estate consultant John Burns, who notes that California housing markets have “less than 10 months supply” of homes for sale, while Florida is “still hugely oversupplied, with most markets currently maintaining more than 16 months of supply.”

Despite the improvement in the California market, Burns believes that it is

too soon to call “the bottom” for California housing, due to the state’s fiscal problems, prospects for higher unemployment and taxes, and future impact of foreclosures on home prices.

As I’ve noted before (see

Greed, Fear, and Loathing or

Foreclosure Zombies) the

foreclosure moratoria (that expired in March 2009) produced a

false sense of well being. The moratoria temporarily halted foreclosure sales – which normally produce foreclosure discounts of roughly 30%.

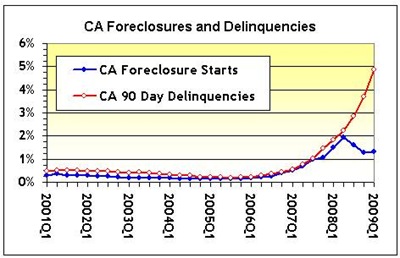

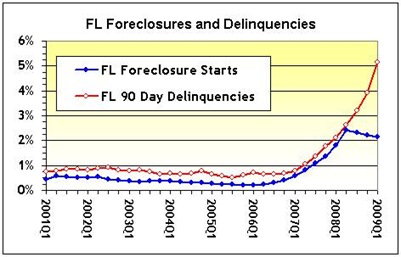

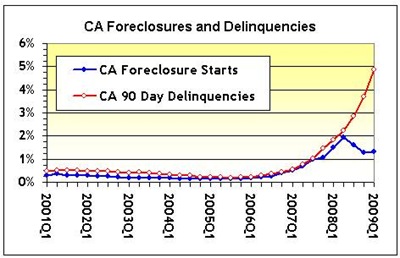

This temporary halt can be most easily seen by comparing a) the 90-day delinquency trends with b) the pace of foreclosures in:

- California - The most populous state, with roughly 12% of the population and 30% of US housing market value; and

- Florida - The 4th most populous state, with roughly 6% of population and 7% of US housing market value.

Figure 1: California 90-Day Delinquencies and Foreclosures (MBA)

Figure 1: California 90-Day Delinquencies and Foreclosures (MBA)

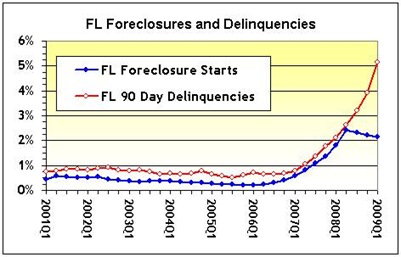

Figure 2: Florida 90-Day Delinquencies and Foreclosures (MBA)

Figure 2: Florida 90-Day Delinquencies and Foreclosures (MBA)

The dislocation between delinquency and foreclosure began in 2008 and continued until 2009Q1, and can be clearly seen in the above two charts. As the foreclosure production lines begin to roll, the pace of foreclosures will more than double … or triple.

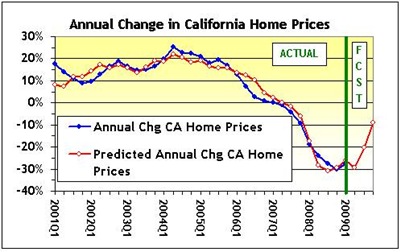

The home price model developed in

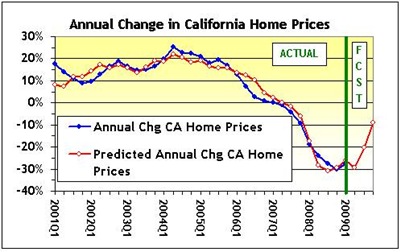

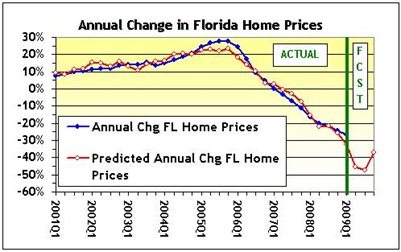

Greed, Fear, and Loathing provides another way to visualize the continued decline in home prices as foreclosures resume.

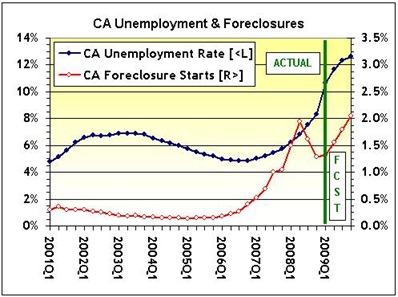

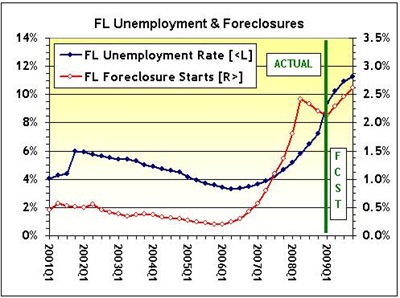

Regional versions of these models relate home prices to unemployment and foreclosures. Below are two charts - for CA and FL - depicting what could easily be rosy scenarios for unemployment and foreclosures in each state.

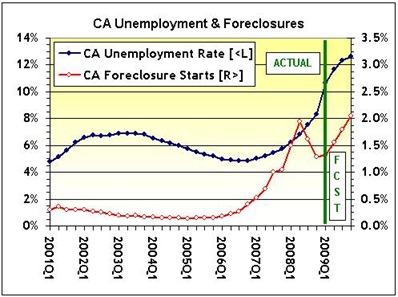

Figure 3: California Unemployment and Foreclosures

Figure 3: California Unemployment and Foreclosures

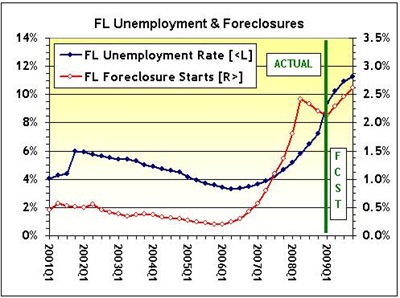

Figure 4: Florida Unemployment and Foreclosures

Figure 4: Florida Unemployment and Foreclosures

I’ve taken a wild guess at predicting unemployment and foreclosures in each state for the rest of 2009. I’m guessing that unemployment continues to worsen, and that foreclosures begin their relentless post-moratoria upward march.

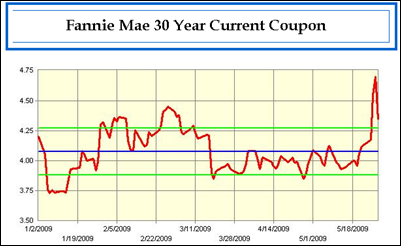

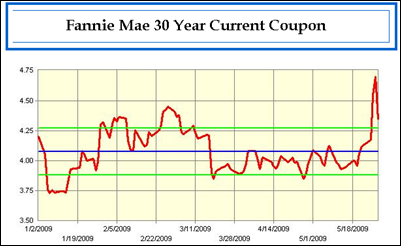

Note: Last week’s spike in mortgage rates – if not reversed – will make things even tougher for the housing market (see Figure 5, below).

Figure 5: Fannie 30 Year Current Coupon, 2009

Figure 5: Fannie 30 Year Current Coupon, 2009

Let’s see what this

might mean for home prices for the rest of 2009.

I’ll begin by aggregating the

Radarlogic/RPX home price series for the MSA’s in CA and FL (using the market value MSA’s weights used in the

RPX Composite) to produce indices for each state that reflect prices of homes financed by both conforming and nonconforming mortgages.

Then, I’ll relate home prices to factors similar to those described in

Greed, Fear, and Loathing, using the CA and FL forecasts discussed above.

What do you get?

As indicated by the graphs below,

perhaps you get something that’s not completely inconsistent with the views of more widely followed real estate consultants.

Figure 6: California Home Prices, Actual and Forecast

Figure 6: California Home Prices, Actual and Forecast

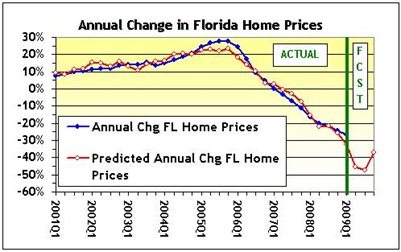

Figure 7: Florida Home Prices, Actual and Forecast

Figure 7: Florida Home Prices, Actual and Forecast

- Continued declines in CA and FL home prices for the rest of 2009;

- Moderation in home price declines – home prices continue to fall in each state, but at a pace that eventually moderates; and

- The California housing market is more robust (i.e., it declines at a slower pace) than the Florida housing market.

I doubt that the above will be right. But if it is, I’ll be sure to dress up in my best formal wear to celebrate the New Year in which a real housing recovery might begin – Happy 2010.

I used to

work with numbers for a living. I’m trying to keep cool as I search for a new job, or at least my next idea. Till next time.

The California and Florida housing markets are as different as black and white.

That’s the view of real estate consultant John Burns, who notes that California housing markets have “less than 10 months supply” of homes for sale, while Florida is “still hugely oversupplied, with most markets currently maintaining more than 16 months of supply.”

Despite the improvement in the California market, Burns believes that it is too soon to call “the bottom” for California housing, due to the state’s fiscal problems, prospects for higher unemployment and taxes, and future impact of foreclosures on home prices.

As I’ve noted before (see Greed, Fear, and Loathing or Foreclosure Zombies) the foreclosure moratoria (that expired in March 2009) produced a false sense of well being. The moratoria temporarily halted foreclosure sales – which normally produce foreclosure discounts of roughly 30%.

This temporary halt can be most easily seen by comparing a) the 90-day delinquency trends with b) the pace of foreclosures in:

The California and Florida housing markets are as different as black and white.

That’s the view of real estate consultant John Burns, who notes that California housing markets have “less than 10 months supply” of homes for sale, while Florida is “still hugely oversupplied, with most markets currently maintaining more than 16 months of supply.”

Despite the improvement in the California market, Burns believes that it is too soon to call “the bottom” for California housing, due to the state’s fiscal problems, prospects for higher unemployment and taxes, and future impact of foreclosures on home prices.

As I’ve noted before (see Greed, Fear, and Loathing or Foreclosure Zombies) the foreclosure moratoria (that expired in March 2009) produced a false sense of well being. The moratoria temporarily halted foreclosure sales – which normally produce foreclosure discounts of roughly 30%.

This temporary halt can be most easily seen by comparing a) the 90-day delinquency trends with b) the pace of foreclosures in:

Figure 1: California 90-Day Delinquencies and Foreclosures (MBA)

Figure 1: California 90-Day Delinquencies and Foreclosures (MBA)

Figure 2: Florida 90-Day Delinquencies and Foreclosures (MBA)

The dislocation between delinquency and foreclosure began in 2008 and continued until 2009Q1, and can be clearly seen in the above two charts. As the foreclosure production lines begin to roll, the pace of foreclosures will more than double … or triple.

The home price model developed in Greed, Fear, and Loathing provides another way to visualize the continued decline in home prices as foreclosures resume.

Regional versions of these models relate home prices to unemployment and foreclosures. Below are two charts - for CA and FL - depicting what could easily be rosy scenarios for unemployment and foreclosures in each state.

Figure 2: Florida 90-Day Delinquencies and Foreclosures (MBA)

The dislocation between delinquency and foreclosure began in 2008 and continued until 2009Q1, and can be clearly seen in the above two charts. As the foreclosure production lines begin to roll, the pace of foreclosures will more than double … or triple.

The home price model developed in Greed, Fear, and Loathing provides another way to visualize the continued decline in home prices as foreclosures resume.

Regional versions of these models relate home prices to unemployment and foreclosures. Below are two charts - for CA and FL - depicting what could easily be rosy scenarios for unemployment and foreclosures in each state.

Figure 3: California Unemployment and Foreclosures

Figure 3: California Unemployment and Foreclosures

Figure 4: Florida Unemployment and Foreclosures

I’ve taken a wild guess at predicting unemployment and foreclosures in each state for the rest of 2009. I’m guessing that unemployment continues to worsen, and that foreclosures begin their relentless post-moratoria upward march.

Note: Last week’s spike in mortgage rates – if not reversed – will make things even tougher for the housing market (see Figure 5, below).

Figure 4: Florida Unemployment and Foreclosures

I’ve taken a wild guess at predicting unemployment and foreclosures in each state for the rest of 2009. I’m guessing that unemployment continues to worsen, and that foreclosures begin their relentless post-moratoria upward march.

Note: Last week’s spike in mortgage rates – if not reversed – will make things even tougher for the housing market (see Figure 5, below).

Figure 5: Fannie 30 Year Current Coupon, 2009

Let’s see what this might mean for home prices for the rest of 2009.

I’ll begin by aggregating the Radarlogic/RPX home price series for the MSA’s in CA and FL (using the market value MSA’s weights used in the RPX Composite) to produce indices for each state that reflect prices of homes financed by both conforming and nonconforming mortgages.

Then, I’ll relate home prices to factors similar to those described in Greed, Fear, and Loathing, using the CA and FL forecasts discussed above.

What do you get?

As indicated by the graphs below, perhaps you get something that’s not completely inconsistent with the views of more widely followed real estate consultants.

Figure 5: Fannie 30 Year Current Coupon, 2009

Let’s see what this might mean for home prices for the rest of 2009.

I’ll begin by aggregating the Radarlogic/RPX home price series for the MSA’s in CA and FL (using the market value MSA’s weights used in the RPX Composite) to produce indices for each state that reflect prices of homes financed by both conforming and nonconforming mortgages.

Then, I’ll relate home prices to factors similar to those described in Greed, Fear, and Loathing, using the CA and FL forecasts discussed above.

What do you get?

As indicated by the graphs below, perhaps you get something that’s not completely inconsistent with the views of more widely followed real estate consultants.

Figure 6: California Home Prices, Actual and Forecast

Figure 6: California Home Prices, Actual and Forecast

Figure 7: Florida Home Prices, Actual and Forecast

Figure 7: Florida Home Prices, Actual and Forecast

1 response so far ↓

1 Ira Artman’s Sterling Slivers: Agent Orange – Henry Flagler And The Creation of Florida // Jun 3, 2009 at 5:52 pm

[...] capitalism and Florida real estate (see my Spring Thawts) are out of favor. It’s time for a … fond tribute to [...]

Leave a Comment