1. Banks could lose $168 billion through PPIP - Jamie McGee and Margaret Chadbourn - If lenders sell their problem loans through the Public-Private Investment Program at market prices, they stand to lose $168 billion. The Federal Reserve told financial institutions to raise $75 billion, but that capital could be erased through their participation in PPIP. The situation partially accounts for why the Federal Deposit Insurance Corp.’s Legacy Loans Program is stalling. - Bloomberg

2. FDIC Said to Delay PPIP Test Sale of Distressed Loans - By Margaret Chadbourn - The U.S. plan to rid toxic loans from banks’ balance sheets has been put on hold as lenders raise capital, a person familiar with the matter said today, suggesting less demand from banks to use the program. - Bloomberg

3. Fed Said to Raise Requirements for Banks to Repay TARP Funds - By Christine Harper and Craig Torres - Federal Reserve officials surprised bankers in the past week by demanding they raise specific amounts of new capital before repaying taxpayer funds, applying a more stringent assessment than the stress tests in May. - Bloomberg ( more glue has been added to the floor of the Roach Motel. BC)

————

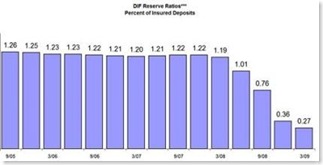

FDIC Fund Running Dry - By: Dirk van Dijk, CFA - … The first graph (from http://www.calculatedriskblog.com/) shows the steep drop in the coverage ratio. Just a year ago, the fund was equal to 1.01% of covered deposits. The current level is its lowest since the first quarter of 1993, when we were digging out from the S&L fiasco. … - Zachs.com

————

FDIC’s Deposit Insurance Fund Reserve Ratio Plunges To 0.27% Of Deposits - Posted by Tyler Durden - … It is worth nothing that since March 31, 15 new banks have failed which includes the biggest one so far this year, BankUnited …It is thus safe to say that the $13 billion has been spent in the past 2 months, especially since banks no longer issue debt under the TLGP (of which, nonetheless, there was $336 billion outstanding at March 31 … - Zero Hedge

————

China Warns U.S. About Debt Monetization - … The most important story of the long weekend and short week is the WSJ account and interview with Dallas Fed President Richard Fisher (call him Mr. $99 trillion in unfunded liabilities, if you will). He’s the inflation hawk on the Fed board and claims to see none percolating yet. … - The Daily Bail

————

FDIC: Do You Believe This Lady? - TheMarketTicker

————

Fed takes considered view of Treasury purchase extensions - By Krishna Guhavv - The Federal Reserve is in wait-and-see mode following the surge in bond yields and mortgage rates that partly reversed on Friday, with -officials unwilling to be bounced into any knee-jerk policy reaction. They plan to wait at least until their policy meeting late this month before deciding whether to extend their purchases of Treasuries and other assets. - FT.com

————

1. details of each - SCENARIOS - Re-shaping Fannie Mae and Freddie Mac - FULL NATIONALIZATION; PRIVATIZATION WITH PAYMENT FOR INSURANCE; COOPERATIVES WITH LOOSE GOVERNMENT TIES; UTILITIES MODEL; PRIVATE MORTGAGE-FINANCE COMPANIES; COVERED BONDS - Reuters

2. Demand for Fed consumer program rises to $11.5 billion - By Kristina Cooke - The flagship U.S. program to revive consumer and small business lending picked up pace in June, showing investors have grown more comfortable with taking part in the government initiative and appetite for risk has increased across all markets. - Reuters

————

Statement of James B. Lockhart III, Director, Federal Housing Finance Agency - “The Present Condition and Future Status of Fannie Mae and Freddie Mac” - FHFA.gov

————

All is well - Moody’s Says US Rating Outlook Stable Despite Debt - Even with a significant deterioration in the US government’s debt position, its rating has a stable outlook and demonstrates the attributes of a Aaa sovereign, Moody’s says in its annual report on the United States. - Research Recap

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment