1. TARP Oversight Panel Says Bank Stress Tests Should Be Repeated - By Robert Schmidt - Regulators should continue to conduct stress tests on banks as long as they keep large amounts of illiquid mortgage securities on their books, a group overseeing the U.S. financial bailout said. - Bloomberg

2. Banks Fleeing TARP Face $5 Billion Warrant Repayment - By David Mildenberg - Ten lenders that persuaded the U.S. yesterday to sell back preferred shares for $68 billion may need to spend another $5.1 billion on warrants held by the Treasury to free themselves from government curbs. - Bloomberg

————

Fed seeks ways to stop banks from taking too much risk - By David Lynch -

WASHINGTON — The Federal Reserve is beefing up its supervision of the nation’s largest banks and developing proposals to ensure that lavish executive compensation … Daniel Tarullo, an expert on financial industry regulation, said Federal Reserve officials plan to scrutinize giant banks with an eye toward practices that might pose a risk to the entire financial system. … - USA TODAY

————

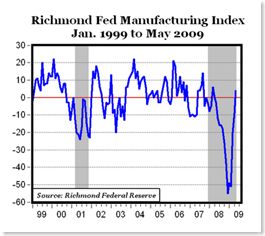

Richmond Fed Rebound Suggests Econ. Recovery - has comments too - Mark Perry - Carpe Diem Blog

————

Commentary - The $787 Billion Mistake - Lee E. Ohanian - (That’s the American Recovery and Reinvestment Act.) - Forbes

————

Obama v. Geithner on TARP Repayments: Save or Spend? - only one is correct -

Obama: 10 banks would be repaying $68 billion in TARP bailout funds, President Obama proudly asserted that the step would reduce the national debt:

vs Geithner:

Timothy Geithner said that the returned funds would “free up resources” for new loans “ - The Heritage Foundation

————

Taxpayers gain $2.7B on bailout ‘investment’ - By David Goldman - Federal Reserve makes billions on interest and Treasury assets, even as its Bear Stearns and AIG bet loses $5.3 billion. - CNNMoney.com

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment