Ginne Mae Issuance of Reverse Mortgage Securities Holds Steady - … In April, GNMA issued $124 Million of HECM MBS securities, which brings the total to $437 million in 2009. … - Reverse Mortgage Daily

————

Scariest Chart I Have Seen in a Long Time - Today’s chart helps provide some perspective as to the magnitude of the current economic decline. Today’s chart illustrates that 12-month, as-reported S&P 500 earnings have declined over 90% over the past 20 months (with over 90% of S&P 500 companies having reported for Q1 2009), making this by far the largest decline on record (the data goes back to 1936). - Chart of the Day

————

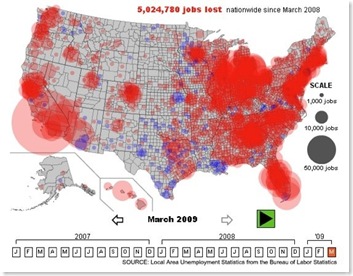

check out unemployment charts - Thoughts from the Frontline Weekly Newsletter - Faith-Based Economics - by John Mauldin

————

Great work regarding declining savings rate - must read -

Americans have not been saving very much. Part of this chart is a dodge, because it doesn’t include the savings people thought they were getting through home price appreciation. But even correcting for that, we see Americans saving less than they have in the past. There are two thoughts that frame this graph for me. Let me share them with you.

1: Materialism and Wasteful Consumption

2: Risk Shifts, Income Traps, Middle-Class Living - much more at RortyBomb

————

A special report - Too big to swallow - The future of securitisation is the industry’s most pressing question - … The really precipitous contraction in credit has come from non-bank lenders—the array of money-market funds, hedge funds, former investment banks, exchange-traded funds and the like that is sometimes called the “shadow banking system”. These capital-market lenders … have supplied only 20% of total net lending in the country since 1993 (see chart 7)—but they play an increasingly important role elsewhere too. … (as major investors) - The Economist

————

Buyout Firms Elude Fed as OTS Lets Private Equity Acquire Banks - By Jonathan Keehner and Jason Kelly - Bloomberg

————

The $1.8 Trillion Question: Inflation Or Deflation? - Bob - Lenzer - … Here’s Cooper’s balanced take on the showdown: “The current state of U.S. policy stimulus, if reversed appropriately at just the right time, would not trigger inflation and currency decline as the economy is running far below full capacity. But once the output gap is sufficiently narrowed, the Fed must drain liquidity and raise interest rates, and the U.S. federal government must cut deficit spending.” Croesus can imagine the Bernanke Fed coping with this change better than the Obama administration, with its ambitious proposals for changing the nation. … - Forbes

————

US CMBS Loan Defaults to Exceed 5% by Year-end: Fitch - Following a substantial jump in first-quarter-2009 (1Q’09), loan defaults for U.S. CMBS are expected to exceed 5% by the end of this year, according to Fitch Ratings. - Research Recap

————

Black Swan, Can You Spare a Dime or a Dollar? More on VAR versus the Put for Capital Allocation - Donald R. van Deventer - Our two posts on capital allocation, comparing the “common practice” of VAR with the Merton and Jarrow put option approach, have prompted an interesting dialogue. … I need you to help me understand why actual bank losses were so much larger than their VAR figures at the time. I thought the VAR numbers were supposed to overstate the true capital needs as measured by the put.” This post explains the differences between black swans, bad VAR, good VAR, and better puts! … - RiskCenter.com

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment