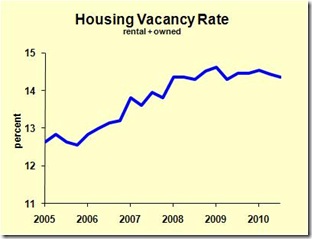

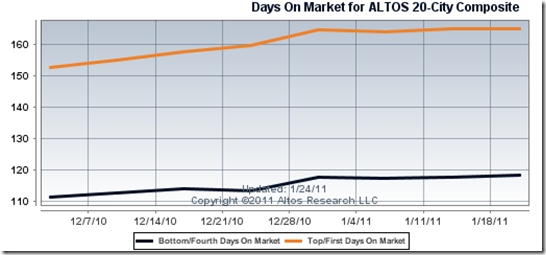

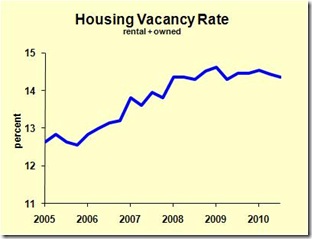

Home Prices: When Will They Recover? - Bill Conerly - … So when will housing prices recover? That’s a somewhat different story. Once we get into supply-demand balance, prices should stop falling. But that does not mean they recover. That peak in prices was unsustainable, due to speculative excess. Going forward, look for something like growth at three percent or so. That implies 10 to 15 years before home prices regain their boom-time peak. … - Businomics Blog

————

New Overlays Are Hurting Loan Brokers - The dynamics of the relationships between mortgage broker and wholesaler have been changed as a result of the housing crisis. And for many on the mortgage broker side of the equation, those changes have not been for the better. Among the issues have been lender overlays, which are adding additional requirements to loan programs beyond what the secondary market investor demands. That was one of the topics discussed by members of the board of directors of the National Association of Mortgage Brokers at the group’s recent NAMB/West conference in Las Vegas. - National Morgage News

Who Says Wholesale Is Dead? - By Paul Muolo - National Mortgage News

————

(slide show) A Frightening Satellite Tour Of America’s Foreclosure Wastelands - Gus Lubin - … For a frightening way to visualize the foreclosure crisis, we’re borrowing a Google maps technique described by Barry Ritholtz. - Money Game at Business Insider

————

Fannie, Freddie Got $20.9 Billion From Loan Buybacks, FCIC Says - By Lorraine Woellert - Fannie Mae and Freddie Mac have received about two-thirds of the $34.8 billion they’ve demanded from lenders for mortgages that failed to meet quality standards, the Financial Crisis Inquiry Commission reported. - Bloomberg

————

For Housing, A Quick Fix Or Less Risk - By FLOYD NORRIS - … But it needs to learn how to do so. It is not just a matter of ideology to say that the country needs a privately financed system of home finance. There are clearly roles for the government to play, as regulator and perhaps as backup financier for those deemed worthy of special treatment, such as veterans or disadvantaged workers who need a helping hand. There can and should be debates on how large that role should be, but just now it is clearly too large. … The best proposal I have heard is a remarkably simple one put forth by John Hempton of Bronte Capital, a hedge fund based in Australia. He says Frannie should simply raise the fee for its guarantee — now about 20 basis points, or one-fifth of a percentage point — every six months by five basis points … - (refers to 2 other ideas) - NY Times

————

States May Require Redocumenting Loans in Foreclosure - by bcoester - By Brian Collins –American Banker - reprint at Appriasal Newscast

————

Daniel Pennell: Mortgage Shenanigans in Virginia (The Wall Street – Washington – Richmond Axes) - By Daniel Pennell, a systems expert who has testified before the Virginia House of Representatives on MERS - …. This cabal managed to kill off a bill (HB-1506) proposed by Delegate Bob Marshall, a bill designed to protect the integrity of the county property records and preserve the integrity of home owner’s title to their property. Simultaneously they attempted to alter the Uniform Commercial Code (UCC) with HB-1718, … In other words a spreadsheet from a bank would be good enough to take someone’s home or report someone to a credit bureau. This was in direct response to a Supreme Judicial Court decision in Massachusetts, Ibanez, … - Yves Smith at Naked Capitalism

————

Wells Fargo Is Ready to Roll - By Dakin Campbell - Careful mortgage lending practices helped the San Francisco bank avoid the problems plaguing large rivals such as Bank of America and Citigroup … Consider this odd tribute to the relative quality of Wells Fargo’s underwriting: … - Businessweek

————

QE2 and Mortgage Rates: Measuring the Fed’s Strategy - Doug Short - … How will we know if the current round of quantitative easing is a success? A key sign will be that a variety of rates will fall — at least until the economy reaches liftoff, which probably means sustained (two or more quarters) real GDP north of 3.3% (the long-term GDP average). … - dShort.com

Tags: Mortgage Market

(must read) 2011 Investment Strategies: 9 Buys, 9 Sells - (excerpted from the January 2011 edition of A. Gary Shilling’s INSIGHT) - John Mauldin’s Outside the Box E-Letter

————

(slide show) Prepare For The Amazing Global Economic Supercycle That’s Going To Blow Away Your Wildest Expectations - Gregory White - The economy is in the midst of a thirty year super-cycle that will see Asia boom to become the dominant economic force in the world, according to Standard Chartered. - Money Game at Business Insider

(gold – silver ratio) Dennis Gartman On The Coming "Surge" In Gold, And The Clobbering In Silver - Joe Weisenthal - … The public has rushed into silver as the “poor- man’s gold” and has to be shaken from its positions before health can be restored. In the process, can we imagine the Gold/Silver ratio trading back toward 55:1 from the present level just barely below 50:1? … - Money Game at Business Insider

————

Wall Street’s new lie to Main Street – Asset Allocation - Mark Cuban - … Today, your investment advisors want you invest in things you have absolutely no fricking clue about and have pretty much absolutely no fricking ability to learn about. They want you to diversify into Emerging Markets, Commodities, International Bonds, Munis, Real Estate Investment Trusts, ….and.. well, a lot of different “stuff”. … - Blog Maverick

————

More of Less - Michael Panzner - Not content to squeeze every ounce of productivity from rank-and-file employees for little extra compensation in return, many large companies also appear willing to cheat their customers and undermine brand values to please Wall Street and line the pockets of senior executives. In "Your Favorite Products - Now 20% Smaller," CNNMoney.com highlights data from Consumer Reports detailing the sleazy and misguidedly short-term-oriented marketing strategy being employed by many "leading" consumer product companies: … - Financial Armageddon

————

Bank lending is definitely picking up - Scott Grannis - Late last year I highlighted a variety of charts that painted a picture of "impressive economic strength." In this post I revisit one that has displayed some impressive follow-through: Commercial & Industrial Loans, a good measure of bank lending to small and medium-sized businesses. - Calafia Beach Pundit

————

R.I.P., Great Bond Bull Market? - Tom Petruno - LA Times Money

————

Retreat on ‘Marking To Market’ - By MICHAEL RAPOPORT - WSJ Markets

————

(interesting) Economic Paper From 1981 Explains Why Only Hedge Fund Managers — Not I-Bankers- Can Make More Than Lady Gaga - Courtney Comstock - Clusterstock at Business Insider

Tags: Mortgage Market

It is the last day of January already? Time flies. This year we have 4 unusual dates: 1/1/11, 1/11/11, 11/1/11 and 11/11/11. Is it a coincidence that you can take the last 2 digits of the year you were born, plus the age you will be this year and it will equal to 111? Maybe this is another Fed regulation…

Of great interest to banks is that the FASB announced that it was dropping a proposal to mark bank loan portfolios to market after a lengthy effort by the banking industry to kill the proposal. Instead, the board will use an amortized cost model, rather than one based on fair value, to measure “financial assets for which an entity’s business strategy is managing the assets for the collection of contractual cash flows through a lending or customer financing activity.”

Companies are certainly hiring out there. Altamont Home Loans, part of Atlantic Home Loans, is hiring in the San Francisco Bay Area: “experienced, high-energy loan officers with a strong desire to dramatically grow their business and personal income. AHL has been around since 1989 and is licensed in 11 states, and provides its loan officers with “the latest technology, phenomenal support, exceptional compensation plans and access to a responsive management team that understands and promotes entrepreneurial spirit. Please send inquiries to [email protected].

Consumer Loan Services is looking for a mid-level Secondary Marketing manager in the Wisconsin area. (The company is a credit union service organization CUSO mortgage operation owned by Marine Credit Union.) Originations come from Marine Credit Union but also from credit unions and small banks in 7 states. CLS is also building a portfolio by private-label servicing for its correspondent clients, a good niche these days. If you’re interested contact the president Jay Garten at [email protected].

A search is on for a National Underwriting Manager position, located in North Carolina, along with senior level wholesale AE’s in Georgia, Virginia, and North Carolina. If you know of anyone, they should contact Paul Conway at [email protected].

Anyone interested in GSE reform and servicing compensation may want to listen in to a Banc of America Securities/Merrill Lynch call today at 7AM PST. Participant Passcode: 1239593, dial-in number US/CAN Toll Free: 1-888-797-2983. (It will also be available for the next 7 days, in replay form, at 1-888-203-1112, Passcode: 1239593.)

HUD issued a mortgagee letter focused on a change in the remittance process for over claimed amounts of FHA single family claims. This modification of the existing process is being made in response to the Department of the Treasury’s mandate for all agencies to switch from their current lockbox services to Treasury’s Pay.gov collection service.

Here is a list you probably don’t want to be on. HUD also announced the cause and effect of termination of DE Approval taken by HUD’s FHA against HUD-approved mortgagees through the FHA Credit Watch Termination Initiative. This notice includes a list of mortgagees which have had their DE Approval terminated.

The FHA flipping waiver was extended. FHA’s “temporary” waiver of the agency’s ‘anti-flipping rule’ was extended through 2011. With certain exceptions, FHA regulations prohibit insuring a mortgage on a home owned by the seller for less than 90 days, but this is now waived. “Since the original waiver went into effect on last February, FHA has insured more than 21,000 mortgages worth over $3.6 billion on properties resold within 90 days of acquisition.”

HUD recently provided additional guidance on claim filing requirements for FHA’s refinance program for underwater borrowers. The program, begun last August, taps funds from the Emergency Economic Stabilization Act (EESA), administered by the Department of the Treasury, for partial payment of a mortgagee’s unpaid principal balance. Mortgagees must first contact the government’s designated claims processor, Wells Fargo, at [email protected] to register and receive directions on how to submit claims.

Wells Fargo had a 25% residential mortgage market share in 2010. So their position on compensation is going to carry some weight. Even though the new compensation rules don’t take effect until April Fool’s Day, agents should know that investors will want loans priced prior to 4/1 to fall under the new arrangement. As an example, Wells Fargo told its broker clients that “Loan files priced under the current compensation rules will need to have a Wells Fargo application date on or before Friday, March 25, or will be subject to the new compensation requirements. All brokers will have to submit loan officer agreements to Wells Fargo by March 15, 2011- including if you are a sole proprietor or a partnership.”

In addition, Wells got the word out that, “When the lender-paid model is used, the broker will need to select a quarterly compensation level. Several lender-paid compensation levels will be available that vary by state, and a minimum and maximum also will be set to ensure compliance with fair and responsible lending principles. More details about the quarterly compensation levels will be provided in the coming weeks - including the specific state levels and the minimums and maximums. This will help broker owners prepare their own loan officer compensation agreements. As you prepare to select a quarterly compensation level and prepare your loan officer compensation agreements, one factor to consider is your PerformanceWorks tier. Your PerformanceWorks tier pricing will be paid through compensation or price on every individual loan - regardless of whether you select the consumer- or lender-paid model. Lender paid loans - the 0.25 or (.125) will increase/ (decrease) compensation to the broker in addition to their chosen lender compensation level. Consumer paid loans - the .25 or (.125) will increase/ (decrease) price to the consumer.”

Below is Part V of the compensation Q&A, put forth by the MBA and Fed. Remember that company’s individual policies may differ from these to some extent, as there is still a lot of interpretation - just don’t steer the consumer into a less favorable product.

more news on Q16-Q18, Egypt and the markets, economic numbers, the markets, and Joke of the Day – click here.

Tags: Commentary · Mortgage Market · Rob Chrisman

(try it out) The CEPR Social Security Benefit Calculator - This calculator estimates your family monthly income during retirement and compares it to other households in your county with similar demographics—your race, age, and marital status. Alternatively, you may compare to the state as a whole. In some cases, the available data may be insufficient to obtain a reasonable comparison. In such cases, the comparison will be to the overall county or state average. - CEPR.net

————

+

+

(How long will you live?) Retirement: Live Long and Don’t Prosper - By Ben Steverman - Confusion about the life expectancy of the Baby Boom generation bedevils fiscal planning and retirement planning - Businessweek

also has Life Expectancy Calculator from Social Security Administration

————

Doug Short has 2 posts with lots of great retirement / financial planning calculators:

Calculating Your Finances, Part 1

Calculating Your Finances, Part 2: Retirement

Tags: Mortgage Market