Last week, Professor Gary Gorton (of Yale and the NBER) took Fed officials on a whirlwind tour of US bank panics. He focused on two periods:

- 1864 – 1913, in which newly established and lightly regulated commercial banks spread across the country, and suffered from frequent panics and failures; and

- 1934 – 2007, the “Quiet Period” following the introduction of deposit insurance, in which few banks (distinct from special-purpose savings and loans) failed.

He did this because he believes that:

- There are similarities between today’s problems and the failure-prone era that preceded the creation of the Federal Reserve;

- Today’s crisis is a modern institutional banking panic that occurred within a relatively new Shadow Banking System; and

- An understanding of what made the “Quiet Period” so quiet (with respect to bank failures) might help fix today’s crisis.

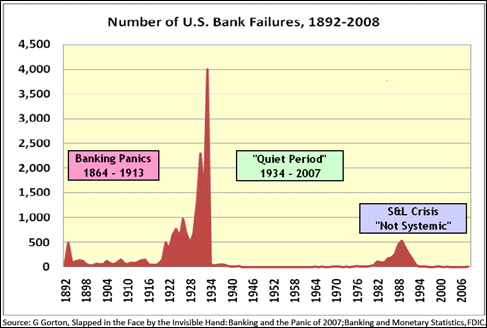

Let’s begin by taking a look at the historical incidence of US banking failures. A chart of bank failures looks something like this:

Figure 1: US Bank Failures, 1892 – 2008.

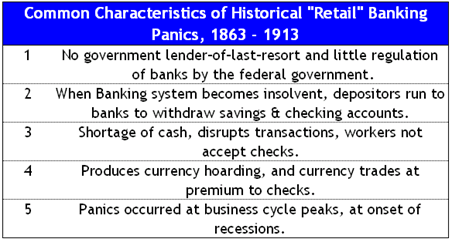

The banking panics that occurred prior to 1913, were “retail panics”, marked by crowds of small investors who swarmed into uninsured banks in an attempt to withdraw their money before the banks went bust. (The S&L failures “don’t count”, since they were largely confined to specialized institutions, rather than the banking system as a whole.)

These retail panics had the following characteristics:

Figure 2: Characteristics of Retail Banking Panics, 1863 – 1913.

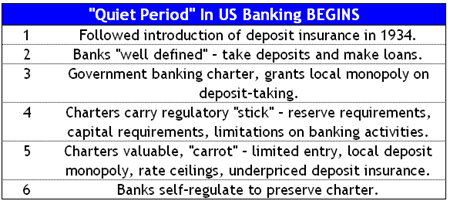

Following the passage of the 1933 Glass-Steagall Act, which created the FDIC and provided for deposit insurance, the US banking system entered the Quiet Period:

- The period from 1934 … until the current crisis is somewhat special in that there were no systemic banking crises in the US. It is the “Quiet Period” in US banking. This Quiet Period led to the view that banking panics were a thing of the past.

G. Gorton, “Slapped In The Face By The Invisible Hand – Banking & The Panic of 2007”, 2009

To explain why the Quiet Period was so quiet, Professor Gorton suggests that it may have been the result of a careful balancing between the:

- “Stick” of bank regulations; and the

- “Carrot” of benefits granted by bank charters.

As summarized below, banks recognized the value of their charters and self -regulated, i.e. respected the rules, to preserve them.

Figure 3: Quiet Period Begins – Bank Charters Are Valuable.

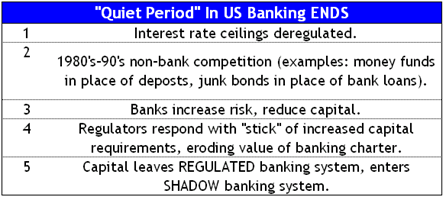

The value of banking charters gradually eroded, as unregulated intermediaries (such as money funds and junk bonds in the late 20th century) exploited loopholes in the banking regulations and began to successfully compete with the regulated banking institutions. Restrictions eventually drove capital and business out of the regulated banking system and promoted the rise of a “shadow banking system.”

Figure 4: Quiet Period Ends – Bank Charters Become Less Valuable, Promoting Rise of Shadow Banking System.

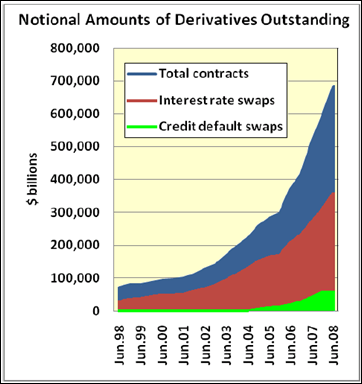

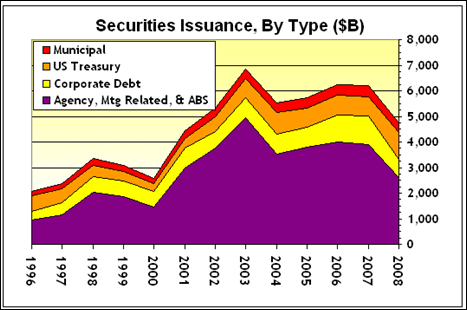

The Shadow Banking System replaced many of the banking functions – but not the federal backing of – the regulated banking system through the use of:

- Derivative securities, such as credit default and interest rate swaps; and

- Securitization, in which loans that had once been funded and held by banks were sold to investors in the capital market.

The following charts, of outstanding swaps and issuance of mortgage or asset backed related securities, suggest the rise of the tough-to-observe Shadow Banking System.

Source: G. Gorton, “Slapped In The Face By The Invisible Hand”, 2009.

Figure 5: Rise of Derivatives – A Proxy For The Shadow Banking System.

Data: G. Gorton, “Slapped In The Face By The Invisible Hand”, 2009

Figure 6: Issuance of Mortgage and Asset Related Securities – Another Proxy For The Shadow Banking System.

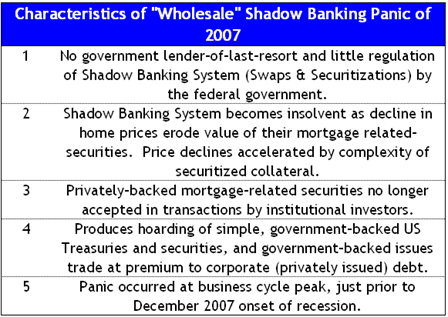

The wholesale, or institutional, banking panic of 2007 began with a home price decline that weakened the credit of privately issued securitizations that lacked any government backing or guarantee.

As summarized in the table below, the Shadow Banking Panic of 2007 shares many similarities with the numerous banking panics that plagued the late 19th and early 20th centuries – except that it is an institutional (or wholesale) panic among large investors, rather than an individual (or retail) panic among small depositors.

Figure 7: Characteristics of Shadow Banking Panic of 2007.

In order to close the loopholes that were exploited to produce the current crisis, and return to the calm of the Quiet Period, regulators should accept that the current crisis IS a (Shadow) banking panic of the Shadow Banking System.

They should then attempt to regulate the system with both carrots (benefits) and sticks (regulations). Professor Gorton suggests that these could include:

- Government insurance for senior tranches of approved asset securitizations;

- Government supervision and examination of securitizations, in place of that previously supplied by private rating agencies; and

- Limit access to the securitization market by determining that any firm that enters the securitization market IS a bank, subject to government supervision.

![]()

I used to work with numbers for a living. These days, I labor in the shadow of the housing bust as I search for a new job, or at least my next idea. Till next time.

1 response so far ↓

1 THE FED IS THE ENEMY « The Burning Platform // Dec 18, 2010 at 1:34 pm

[...] Source: Mortgage News [...]

Leave a Comment