![]()

Sources: JustPlaneModels.com, and Marcus Santos/NY Post, Barclays Sign, © 23 Sep 2008.

JUST GET OVER IT!

I’m NOT talking about the brouhaha (i.e., “loud confused noise from many sources”) over AIG’s boni. This is NOT the place to discuss the Captain Renault-like shock that rained from the clouds when US companies obey laws passed by Congress and signed by the President.

I’m referring to British displeasure with gifts presented by the First Lady to the children of their Prime Minister Gordon Brown, during a recent White House visit:

- “Like all good guests, Sarah Brown arrived bearing gifts for the [President’s] children… And they were really nice… A bit of thought had clearly gone into choosing them: Top Shop dresses (with matching necklaces) and a selection of books by British authors. Lovely.

- … These were gifts chosen in the true spirit of present-giving: to please the recipient, not the giver.

- In return Mrs. Obama gave the Brown children…two toy models of Marine One, the Presidential helicopter. Fair enough on the helicopter part, always a popular choice with small boys; but Marine One? … Mrs. Obama’s gesture could not have been more solipsistic or more inherently dismissive of Mrs. Brown.”

Source: Sarah Vine, The Times of London, First Lady shows even she has a gift for the gaffe, 5 Mar 2009.

Have the British already forgotten that the US government’s inept bailout handed over the best parts of Lehman Brothers to the British Barclays for a pittance?

Barclays bought the bankrupt firm’s North American investment operations for just $250MM, including its New York headquarters. What more do the British want? The rest of Manhattan? Let them buy their own “thoughtful” gifts!

Proof - that the deal was a steal - can be seen in the quality and importance of the research in Barclays Capital’s latest Securitized Products Weekly. It is produced by what had been Lehman Brothers’ fixed income research team.

I’m focusing - in particular - on Sandeep Bordia and Sandipan Deb’s six-page piece, Re-default rates for modified loans.

Someone in the Administration (certainly NOT the Treasury Secretary, his hands are more than full) might want to place this nuanced and thoughtful study of the performance of prior subprime mortgage modifications before the powers that be - or would be, if they were not watching the other March Madness.

Bordia and Deb carefully develop a customized version of a Loan Performance database of prior subprime mods. They divide the data into four categories:

- Debt forgiveness;

- Debt forgiveness with rate reduction;

- Principal and interest (P&I) recapitalization; and

- Rate reduction (includes combination with P&I recaps).

They then present a series of models that measure the extent to which the modified loans tend to redefault.

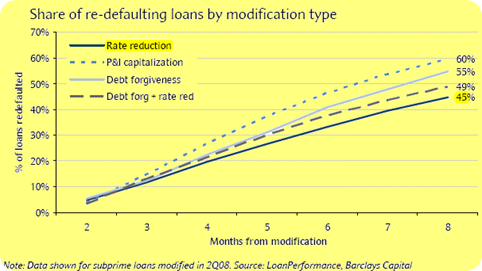

They find that a superficial look at the data suggests that rate reduction modifications (similar to that envisioned by the Administration’s Making Home Affordable program) are more effective than other types of modifications, and have a lower redefault rate. See Figure 1, below.

Figure 1: Redefaults, within eight months, by modification type.

Source: Barclays Capital.

After a more careful analysis, Bordia and Deb suggest that Rate Reduction’s apparent superiority (in terms of lower redefault percentages) reflects the fact that while the:

- Majority of all types (*) of modified loans were delinquent when modified;

- Most of the borrowers receiving rate reductions were current when their loans were modified.

(*) That is debt forgiveness, debt forgiveness with rate reduction, principal & interest recapitalization, and rate reduction.

In other words, rate reductions plans went to distressed, but less delinquent, borrowers; and this accounts for the better performance of rate reduction programs. The Barclays Capital analysts then proceed to develop redefault models for rate reduction programs that take into account the extent of rate reduction.

Noting that the “current focus of the HAMP program announced by the … Administration is on rate reduction” modifications, Bordia and Deb expect that the average rate reduction will be about 3% for typical subprime pools. Based on their analysis this suggests that:

- Current loans receiving rate modifications will experience a 62% redefault rate; while

- Delinquent loans receiving rate modifications will experience an 83% redefault rate.

In contrast, they estimate that unmodified subprime loans that are still current will experience a 70% default rate, basically between the figures for the current modified [62%] and delinquent modified [83%] loans, noted above.

Bordia and Deb conclude, in part, by noting:

- Given the current prepayment environment and re-default rates, it is most likely that a majority of the modified loans will end up in default.

- Assuming 50% of the outstanding balance gets rate modified and applying our expected re-default rates will result in only modest improvement in overall defaults on a pool. For typical subprime pools, the default rate would come down to 70-75% from 80-85% pre-modification.

Why bother? The Administration’s “plan” – such as it is – will only reduce the default rate “to 70-75% from 80-85% pre-modification.”

Do the math. As the Administration notes in the Program Fact Sheet, the modification program will provide modifications for “up to 3 to 4 million at-risk homeowners”. Let’s split the difference and call it 3.5 million homeowners.

According to the Administration’s Fact Sheet, the program will cost $75 billion. Roughly speaking, this works out to a “per mod” cost of about $21,400 per modification.

Let’s suppose that the Barclays analysts are correct, and that the program reduces the default rate by 10 percentage points (i.e., “to 70-75% from 80-85% pre-modification.”) This means that the cost – for each averted default – is much larger than the $21,400 cost per modification. In fact, it’s more like $214,000 for each averted default.

According to the Federal Housing Finance Agency’s 26 Feb 2009 report, the “average loan amount [was] …$211,500 in January, 2009.”

In other words, the average cost per averted default exceeds the average size of recently originated loans. How does this make any sense?

Wouldn’t the money and effort be better spent if it were devoted to income tax cuts, tax credits and more broad-based stimulative macro-policies? Isn’t this the sort of national discussion we should be conducting?

I KNOW we are supposed to hopeful, but I believe that the screams of bonus envy and the roar of toy helicopter engines have drowned out critiques of the Administration’s mortgage programs. Where’s the change?

- - - - - - - - - - - ![]()

I used to work with numbers for a living. I wonder if my job search will ever take off as I continue my search for a new job, or at least my next idea. Till next time.

REFERENCES

Sandeep Bordia & Sandipan Deb, Barclays Capital Securitized Products Weekly - Re-default rates for modified loans, 20 Mar 2009.

US Treasury, Making Home Affordable Fact Sheet, 4 Mar 2009.

3 responses so far ↓

1 Workouts Work Worse | Photomaniacal // Mar 22, 2009 at 12:15 pm

[...] another great post, expert analyst Ira Artman cuts right to the heart the matter of the Obama administration’s [...]

2 » Workouts Work Worse // Mar 24, 2009 at 3:40 am

[...] another great post, expert analyst Ira Artman cuts right to the heart the matter of the Obama administration’s [...]

3 Finally, someone did the math « BettyKincaid’s Blog // May 22, 2009 at 11:25 pm

[...] Barclays Capital’s latest Securitized Products Weekly includes a six-page research article titled Re-default rates for modified loans that’s probably as dry a read as it sounds. Thankfully, we have Ira Artman to give us the Reader’s Digest version: [...]

Leave a Comment