US Senators Outperform Market by 12% per year - A 2004 study finds that United States senators outperformed the market by 12% per year versus the -1.4% underperformance of the average US household during the same period. Even corporate insiders paled in comparison at a 6% out-performance per annum. Do you think there was any insider knowledge that assisted these non-financially savvy senators? I am sure that a 12% return per year is quite the hefty supplement to their salaries and pensions. I wonder if that will keep a cap on capital gains taxes … - Surly Trader

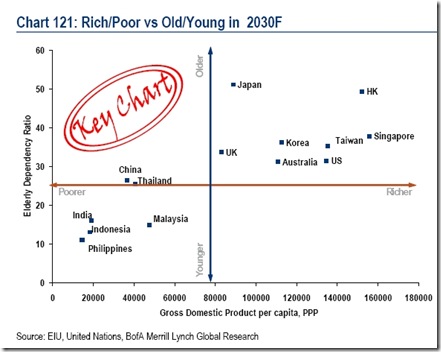

Aging Developed Nations - The demographics of developed nations are becoming increasingly dire. I have looked briefly at old age dependency ratios in the past, but I think that as we assess sovereign risk and growth rates it is an opportune time to revisit these stats. … but more importantly it means that pension and entitlement systems will be stressed. When you have 2 people supporting 1 retiree, it requires significant taxation to fund which generally leads to lower economic competitiveness … - Surly Trader

————

US Companies May Face US $1 Trillion in Additional Capital and Liquidity Requirements as a Result of Financial Regulatory Reform - … according to research (ISDA). About $400 billion would be needed as collateral that corporations could be required to post with their dealer counterparties to cover the current exposure of their OTC derivatives transactions. ISDA estimates that $370 billion represents the additional credit capacity that companies could need to maintain to cover potential future exposure of those transactions. If markets return to levels prevailing at the end of 2008, additional collateral needs would bring the total to $1 trillion. … - RiskCenter.com

————

Time to shut down the US Federal Reserve? - Ambrose Evans-Pritchard - Like a mad aunt, the Fed is slowly losing its marbles. Kartik Athreya, senior economist for the Richmond Fed, has written a paper condemning economic bloggers as chronically stupid and a threat to public order. Matters of economic policy should be reserved to a priesthood with the correct post-doctoral credentials, which would of course have excluded David Hume, Adam Smith, and arguably John Maynard Keynes (a mathematics graduate, with a tripos foray in moral sciences). - Telegraph.co.uk

plus this priceless post from zero Hedge: The Fed Has Lost It; Publishes Essay Bashing Bloggers, Tells General Public To Broadly Ignore Those Without An Econ PhD - Submitted by Tyler Durden - Zero Hedge

————

Loan Giants Threaten Energy-Efficiency Programs - The Obama administration is devoting $150 million in stimulus money for programs that help homeowners install solar panels and other energy improvements, which they pay for over time on their property tax bills, Todd Woody reports in The New York Times. … (FN and Freddie) are threatening to derail the effort by warning that they might not accept loans for homes that take advantage of the special financing. … 22 states have authorized such programs, which are intended to make it easier and cheaper for homeowners to invest in energy efficiency… more details - NY Times Dealbook

————

Fed Made Taxpayers Junk-Bond Buyers Without Congress Knowing - By Caroline Salas, Craig Torres and Shannon D. Harrington - … “Either the Fed did not understand the distressed state of some of the assets that it was purchasing from banks and is only now discovering their true value, or it understood that it was buying weak assets and attempted to obscure that fact,” Senator Sherrod Brown, an Ohio Democrat and member of the Senate Banking Committee, said in an e-mail when informed about the credit quality of holdings in the Maiden Lane LLC portfolio. The committee held the April 3 hearing. … - Bloomberg BusinessWeek

————

Chicago Fed’s Evans: … Wary of additional asset purchases by U.S central bank; jobs remain a sore point - Charles Evans, president of the Federal Reserve Bank of Chicago, said Wednesday he’s "wary" of calls for further central-bank purchases of assets aimed at stimulating the economy while dismissing fears that the U.S. recovery is faltering. "There are limits to what policy can do," especially to improve the nation’s labor market, Evans said in a television interview on CNBC. … Some economists, however, believe the Fed must purchase additional securities to keep the economy from slipping into a double-dip recession. … - MarketWatch

————

Why The Greater Depression Still Lies Ahead - Michael Pento - Obama, Bernanke pile on debt when de-leveraging is needed - Forbes

————

AIG, Fannie Mae and Freddie Mac Continue to Hire Despite Bailout - As politicos anticipate the June jobs report, which comes out today, many are assuming a bleak picture. But, rest assured, there are still companies hiring—in particular AIG, Fannie Mae and Freddie Mac. Yes, it seems you can still hire, even while on the verge of bankruptcy. - The State Column

————

wow - Reform bill would require clearing of forex swaps - Legislation to overhaul financial regulation would require clearing of foreign exchange swaps and forwards. - Risk.net

————

has lots of details - Six Months to Go Until The Largest Tax Hikes in History - From Ryan Ellis - ATR.org - In just six months, the largest tax hikes in the history of America will take effect. They will hit families and small businesses in three great waves on January 1, 2011:

First Wave: Expiration of 2001 and 2003 Tax Relief

Second Wave: Obamacare

Third Wave: The Alternative Minimum Tax and Employer Tax Hikes

————

Elizabeth Warren: Why Credit Is Still Frozen - By John Tozzi - The congressional TARP watchdog says there’s no evidence that the $700 billion bailout boosted lending to small business - Bloomberg BusinessWeek

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment