After Roy Lichtenstein, TIME June 21, 1968.

After Roy Lichtenstein, TIME June 21, 1968.

I

wish I could

take full credit for my heist of Lichtenstein’s

TIME ™ cover – but I can’t.

Credit belongs to Geetesh Bhardwaj and Rajdeep Sengupta, co-authors of two disturbing St. Louis Fed working papers:

- Where’s the Smoking Gun? A Study of Underwriting Standards for US Subprime Mortgages (WP 2008-36, Apr 2009); and

- Did Prepayments Sustain the Subprime Market? (WP 2008-39, May 2009).

Credit also has its place in a well-underwritten mortgage loan. But - as their recently revised works suggest - subprime loans replaced

creditworthiness with

transactions, riddling holes in the US economy.

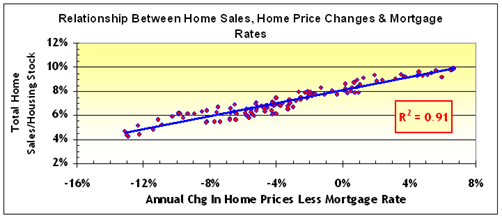

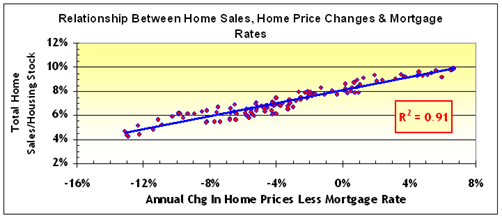

I’ve previously observed (

No News Is … No News) that there is a

tight relation between home price appreciation and transactions - IF you measure the former by

price change in excess of financing cost, or

carry; and the latter by the

percentage of existing homes sold, or

turnover.

The following chart from that article depicts this relationship:

Figure 1: Scatterplot of Carry and Turnover, 1978 – 2008.

Figure 1: Scatterplot of Carry and Turnover, 1978 – 2008.

The two Fed working papers suggest how subprime lenders, borrowers, and regulators

exploited this link between transactions and home price appreciation to create the

appearance of a viable mortgage product, as long as home prices were increasing.

SUBPRIME UNDERWRITING STANDARDS

The first paper -

Where’s The Smoking Gun? – tackles the shibboleth that:

- A dramatic weakening of subprime underwriting standards - beginning in late 2004, and extending into early 2007 - triggered the turmoil in financial markets.

Bhardwaj and Sengupta look at data from more than 9 million mortgages originated between 1998 and 2007, and ask two questions:

- Was there a dramatic weakening of underwriting standards within the subprime mortgage market?; and

- Did this weakening begin around late 2004?

Their

detailed loan-by-loan analysis does NOT reveal

any deterioration in underwriting standards for subprime originations, if “underwriting” is defined to include a

variety of characteristics, such as LTV, FICO scores, and documentation.

Over the period, relaxed standards in one factor (such as documentation) were offset by tighter standards for other factors (such as LTV or FICO).

They conclude that if

loans underwritten in 2005, 2006 or 2007 were originated in 2001 or 2002, then they would have performed significantly

better on average than loans that were actually originated in 2001 or 2002.

So, if there was NO

smoking gun, what hijacked the subprime market and caused it’s downfall?

SUBPRIME PREPAYMENTS

In the second paper -

Did Prepayments Sustain the Subprime Market? - Bhardwaj and Sengupta reexamine their 9 million-loan dataset. They first observe that subprime loan features prevented borrowers from refinancing into a different mortgage for at least two years.

- Over seventy percent of subprime originations for each origination year were refinances;

- A significant majority of these originations were hybrid-ARMs designed to reset into a fully indexed rate after two or three years;

- Contrary to conventional wisdom, teaser rates on hybrid ARMs were not low and not significantly different from those of fixed rate subprime loans; and

- Most subprime originations included prepayment penalties with the prepayment term expiring on or after the ARMs’ reset date.

The economists conclude that that the

viability of subprime loans depended upon

continued home price appreciation:

- The subprime mortgage design sought to benefit from short-term home price appreciation;

- When home prices rise, borrowers can build up equity in their homes and become “less risky” on subsequent mortgages;

- This allows borrowers to refinance at a lower interest rate (on their subsequent loan), reducing their likelihood of default;

- Subprime loans functioned, to some extent, like a bridge loan, providing temporarily credit-impaired borrowers with access to short-term financing; and

- The majority of all subprime loans were only viable as long as home prices continued to appreciate – once home prices slowed or declined, the borrowers no longer had a viable “exit option”, that they could trigger either by refinancing their mortgage or selling their home.

Once home prices failed to increase in 2006, subprime borrowers could not economically cover their debts by rolling over their old subprime loans.

It was the

lack of a profitable “exit option,” rather than any late-stage underwriting failure, that shot a hole through the heart of the subprime mortgage market.

I used to

work with numbers for a living. I’m giving it my best shot as I search for a new job, or at least my next idea. Till next time.

After Roy Lichtenstein, TIME June 21, 1968.

I wish I could take full credit for my heist of Lichtenstein’s TIME ™ cover – but I can’t.

Credit belongs to Geetesh Bhardwaj and Rajdeep Sengupta, co-authors of two disturbing St. Louis Fed working papers:

After Roy Lichtenstein, TIME June 21, 1968.

I wish I could take full credit for my heist of Lichtenstein’s TIME ™ cover – but I can’t.

Credit belongs to Geetesh Bhardwaj and Rajdeep Sengupta, co-authors of two disturbing St. Louis Fed working papers:

Figure 1: Scatterplot of Carry and Turnover, 1978 – 2008.

The two Fed working papers suggest how subprime lenders, borrowers, and regulators exploited this link between transactions and home price appreciation to create the appearance of a viable mortgage product, as long as home prices were increasing.

SUBPRIME UNDERWRITING STANDARDS

The first paper - Where’s The Smoking Gun? – tackles the shibboleth that:

Figure 1: Scatterplot of Carry and Turnover, 1978 – 2008.

The two Fed working papers suggest how subprime lenders, borrowers, and regulators exploited this link between transactions and home price appreciation to create the appearance of a viable mortgage product, as long as home prices were increasing.

SUBPRIME UNDERWRITING STANDARDS

The first paper - Where’s The Smoking Gun? – tackles the shibboleth that:

1 response so far ↓

1 Economic Principals » Blog Archive » Landing on Those 240 Inches // Jun 7, 2009 at 4:00 pm

[...] on the autonomous model of the NTSB. (Artman has kept up a steady stream of excellent commentary as Sterling Slivers at [...]

Leave a Comment