stock market peak? - Bill Gross new piece - Midnight Candles - Investment Outlook November 2009 - … I’ll jump straight into a discussion of why in a New Normal economy (1) almost all assets appear to be overvalued on a long-term basis, and, therefore, (2) policymakers need to maintain artificially low interest rates and supportive easing measures … The Fed will likely require 12–18 months of 4%+ nominal growth before abandoning the 0% benchmark. … conclusion … if you wish, but the six-month rally in risk assets – while still continuously supported by Fed and Treasury policymakers – is likely at its pinnacle. … - PIMCO

————

Primer on how option arms work - long but a good reference piece - Will Option ARM Loans Still Implode? - Contributed by Patrick Pulatie, CEO, Loan Fraud Investigations - IAmFacingForeclosure.com

————

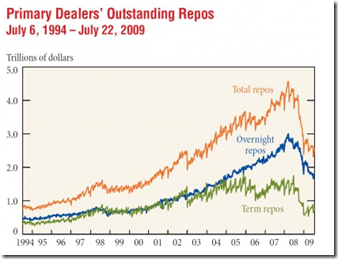

propping up stocks? - Primer on tri-party repos - long but essential reading - An Overview Of The Fed’s Intervention In Equity Markets Via The Primary Dealer Credit Facility - … on September 14, 2008, the Federal Reserve first established what is known as the Primary Dealer Credit Facility (PDCF), and subsequently amended it, so that the Fed, in becoming the lender of last resort, would allow any collateral, up to and including stocks … By doing so, the Federal Reserve effectively gave a Carte Blanche to primary dealers to purchase any and all equities they so desired, with such purchases immediately being funded by the US taxpayer, via the PDCF. In essence, this was equivalent to the Fed purchasing equities by itself through a Primary Dealer agent. … - Tyler Durden - Zero Hedge

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment