To Our Clients, Colleagues and Friends,

- We’ve gotten lots of responses to our recent writings on secondary marketing leakage, our favorite one being that “Leakage reminds me of the time I owned a convenience store. There are only three people that will steal from you. Customers, employees and suppliers.”

- We read Bill Clinton’s autobiography My Life when it first came out, and we just read that there are about 3 million copies in print. Remembering how thick it was (999 pages), we pulled it out of our bookshelf and weighed it, and it came out to about three and a half pounds. That comes out to a bit over 5,000 tons. If we assume that Kirstie Alley weighs around 350 pounds, the weight of all copies of My Life in print would be the equivalent of 30,000 of her.

- Speaking of the Rotund One, whatever happened to the actress who originally played Kirstie’s role on Cheers? We really liked her personality.

- For all the mortgage-related topics we try to sound intelligent on, one of the bigger responses we get is when we run the original names of famous people. Here are some more:

|

James Garner (James Bruderlin) |

Tom Cruise ( Tom Mapother) |

|

Jane Seymour (Joyce Frankenberg) |

Traci Lords (Nora Kuzma) |

|

Jane Wyman (Sarah Fulks) |

Rocky M arciano (Rocco Marchegiano) |

|

Janis Ian (Janis Fink) |

Snoop Dog (Cordazer Broadus) |

|

Jerry Lewis (Jerry Levitch) |

Mother Teresa (Agnes Gonxha Bojaxhiu) |

|

Walter M atthau (Walter Matuschankatasky) |

Stevie Wonder (Steveland Judkins) |

|

Tiger Woods (Eldrick Woods) |

Truman Capote (Truman Streckfus) |

|

Tim Allen (Tim Dick) |

Pat Benatar (Patricia Andrejewski) |

|

Robert Blake ( Michael Gubitosi) |

Pia Zadora (Pia Schipani) |

Tim Allen is a pretty bland name, but it’s still much better than Tim Dick. And although you meet very few Bulgarians these days, you have to love their names. Bulgarian-born M other Teresa’s original name was very typically Bulgarian, with the letter “X” appearing twice. Finally, there’s Pia Zadora. When this fourth-rate actress married a very wealthy man maybe 20 years ago, he financed an off-Broadway production of The Diary of Anne Frank so his young wife could play the leading role. On opening night she was so horrible, and this is a true story, that when the Nazi’s came knocking on the door looking for Jews who might be hiding, the audience yelled out “She’s in the attic.”

- We got absolutely tons of e-mails about Eagle Scouts. One we liked was “My brother and I are Eagle Scouts and my aunt’s family had all 3 boys as Eagles. My Uncle was an Eagle too.” And from David Wales at Gateway Bank: “I told my son that being an Eagle Scout is the only thing that you can do as a kid that you will be proud to put on your resume when you become a man.”

- Microsoft has a market cap of $245 billion. Does it surprise you that Apple is not all that far away at $178 billion?

- Capital Markets Cooperative chief Tom Millon wrote us about the baseball Hall of Fame photo last week. Tom’s great great-uncle was Christie Mathewson who should have been in the picture. In 1936 Mathewson joined Babe Ruth, Honus Wagner, Ty Cobb and Walter Johnson as the first class of baseball Hall of Fame inductees. He would have been in that photo, but he was gassed while fighting in WWI and died shortly afterwards from damage to his lungs.

- Lots of comments about our comment about The Who singing about teen age wastelands and so on. The guy who figured out how to transition from being rebelliously young to getting older was 1960’s “activist” Jerry Rubin. The diminutive Rubin coined the phrase “Never trust anyone over 30”, and when he turned 30, he said “It’s now don’t trust anyone under 30!”

- We’re always fascinated by entrepreneurial businesses, and we just saw one that really impressed us. We were walking down College Avenue in Berkeley with Evan Stone , and when it started to pour, we ducked into a dress shop to get out of the rain. It tuned out to be a place where you can rent (you meaning you women) the fanciest dress for 2-3 nights. Think about it: What if you got invited to the White House for a State Dinner? Do you really want to spend $1,000-3,000 for a gown you’ll only wear once? Here a woman can rent it for maybe $150-200. Anyway, it’s www.dress-sf.com. And if you do get invited to a State Dinner at the White House, can we be your date?

- A good test for someone who claims to have been hip in the sixties is to ask them to complete this sentence “People try to put us down….” The correct answer is “…. just because we get around.” If there were SAT tests for Boomers, the creative writing part could have this: Compare and contrast the lyric “People try to put us down, just because we get around” by The Who with “Round round get around, I get around” by the Beach Boys. Extra credit for explaining what it means to “get around.”

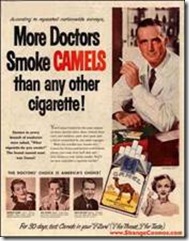

- There was a time when smoking cigarettes was a sign of sophistication. There was also a time when magazines ran ads like this one. Times have changed.

- This is from a mortgage analyst at a large bank: “Let’s look at your comment on Warren Beatty: Born in 1937; that makes him 73 years old. Let’s assume he had no sexual activity until he was 15….. that gives him 58 years to accumulate his total of 12,775 women (more or less). He married in 1992. Assuming he stayed faithful all those years (a stretch, I know), that gives him 40 years to bed 12,774 women, plus 1 Annette Benning. 12,774 / 40 years = 319 per year. This ignores time spent in other long-term relationships where he spent at least some time attempting monogamy (Julie Christie, Natalie Wood, Madonna, etc.).

Just to make it round, let’s say he spent the other 46 days per year in monogamous relationships over 40 years- that equals 1800 days, or about 5 years worth of his adult life in his 37 years of adulthood prior to getting married. So he’s saying that he basically slept with, on average, a different woman almost every single day for 40 years straight.” We changed a few words for the sake of propriety, but this is one analytical mind at work. It’s not a surprise that this guy is a well respected mortgage analyst at a well known Wal Street firm. - As we deal with banks around the country, it seems that if they have just one non-performing loan, if the rest of the portfolio is performing fine, that one bad loan is always a participation. At least it seems that way,

- More from clients on re-purchases: “We have only had a few repurchases. Our experience has been that we lost 20% of the loan balance. I expect that if we had one today the loss would be much larger as prices have dropped. We have foreclosed or taken a deed on lieu on all our repurchases.”

- From a client on leakage: “We track leakage on each loan….we’ve done it for ten years now, and as the owner, it’s one of the numbers I really focus on.”

- Wells Fargo isn’t just great at loan production, but they also make money on their loan servicing + the valuation of their servicing portfolio, Last year, Wells picked up $6.3 billion in the valuation of that portfolio, and to make it even sweeter, they made additional millions on their servicing hedge.

- In about 90% of all FOCIS-plus Reports, we comment that the company needs to have a regular, ongoing and formal process for reviewing counterparty risk with all the vendors and entities with which it does business. How often do you review your counterparties? Do you have criteria you use to assess them? Anyway, the American Banker article had an article this morning on TierOne Bank and their problems. The bank is “significantly undercapitalized”, has struck a deal to sell nearly half its branches, and is suffering from a high level of non-performing construction loans. We hope for the best with TierOne and think they’ll probably raise capital and be just fine, but “hoping for the best” is not a strategy, and if you have a warehouse line with them, you really need to assess their situation.

- Among the mortgage insurers, there’s MGIC, PMI, Radian, Old Republic , Genworth, Triad and United Guarantee. But what about those that no longer exist? Let’s see, there’s Verex, Tiger IMI, AMI, and Ticor, but that’s all we can remember. Which other ones did we miss? Anyone? Anyone?

We love the attachment, Laws of Lending. Some of these “laws” can make you laugh, but they can also make you cry. And all of them are true. A favorite is #3, that Collateral always liquidates for less than it should. Good luck with all your collateral! See you next week.

“Helping lenders increase revenues, control costs, and better manage risk.

- Mike McAuley ([email protected])

- Corky Watts ([email protected])

- Joe Garrett ([email protected])

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment