Bill would cut all funding to HUD - by JON PRIOR - Sen. Rand Paul (R-Ky.) introduced a bill this week that would cut $500 billion in government spending by the end of 2011, and one of the many casualties is the Department of Housing and Urban Development. According to the language in the bill, once ratified, all accounts and programs for HUD would be immediately defunded. It would also transfer all housing programs for veterans away from HUD and into the Department of Veteran’s Affairs. - more – Housingwire

————

Fannie, Freddie seek to cut dividend on government stake: report - Mortgage companies Fannie Mae and Freddie Mac have been lobbying the Treasury to accept a lower dividend on the preferred stock issued during the government bail out, the Financial Times said, citing people familiar with the situation. - Reuters

————

Subprime Bets Made by 50 Hedge Funds, Greg Lippmann Told FCIC - By Jody Shenn - Greg Lippmann, who gained fame for his bets against subprime mortgage securities, brokered wagers against the bonds to at least 50 hedge funds during 2006 and 2007, the former Deutsche Bank AG trader told the Financial Crisis Inquiry Commission. - Bloomberg Businessweek

Moody’s Assumed 4% Annual Home Price Rises in Bond Rating Model - By Matthew Leising and Katrina Nicholas - Moody’s Corp. assumed U.S. home prices would rise 4 percent a year when it developed a model in 2003 to rate mortgage-backed securities, according to the Financial Crisis Inquiry Commission. Prices instead plunged 28.5 percent from July 2006 through the low reached in February last year, according to the Chicago- based National Association of Realtors. Moody’s failed to foresee the decline, the commission concludes in a 545-page book seen by Bloomberg News and due to go on sale today - Bloomberg Businessweek

————

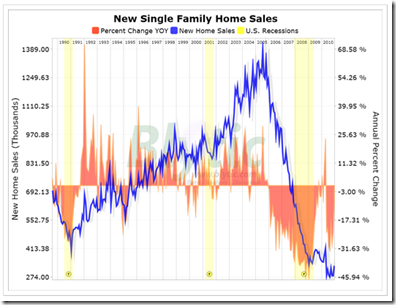

New-home sales in 2010 fall to lowest in 47 years - AP - Buyers purchased fewest number of new homes last year in nearly half a century - Sales for all of 2010 totaled 321,000, a drop of 14.4 percent from the 375,000 homes sold in 2009, the Commerce Department said Wednesday. It was the fifth consecutive year that sales have declined after hitting record highs for the five previous years when the housing market was booming. - Yahoo Finance

————

(Servicing standards to be included in definition of QRM?) Attorney General Madigan: New Gold Standard For Home Loans Must Hold Banks Accountable To Homeowners/Investors - … Attorney General Madigan’s letter to the Federal Deposit Insurance Corporation, U.S. Treasury and other federal financial regulators was also signed by her counterparts in 10 other states. Madigan calls on the regulators to demand tighter mortgage servicing standards as they implement provisions of the Dodd-Fran … - eNews Park Forest (IL)

————

(has document) US Bankruptcy Trustee Takes Interest in “Ta Dah” Documents Mysteriously Appearing in Foreclosures (aka Probable Fabrications) - Yves Smith - … A new development is that the US Bankruptcy Trustee, which is part of the Department of Justice, has started poking around the nether world of slipshod and possible made-up documents, and is asking banks to explain what they are up to. These inquiries may be paving the ground for broader-based action. The case in question is a Connecticut Chapter 13 filing … - Naked Capitalism

————

U.S. Regulators Zero In on Loan Servicers to Fix Foreclosures - By Prashant Gopal and Lorraine Woellert - … Changes being studied include a new fee structure for servicers, independent reviews of rejected requests to ease loan terms and a fund to compensate victims of improper foreclosures, according to Bair and other federal and state regulators. Lawmakers have proposed reining in the privately run Merscorp Inc., even as the company says it could serve as a national mortgage registry. While regulators are in the early stages of their work, any changes probably will raise the cost of servicing loans, which would mean higher costs for homeowners. .. - Bloomberg

————

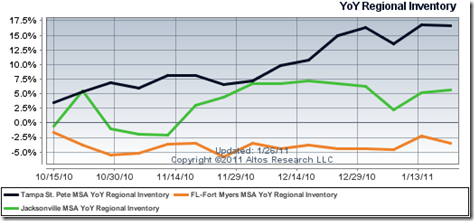

Florida’s Foreclosure Pipeline: Inventory & Prices - by SCOTT SAMBUCCI - A question we hear every day – “What about the shadow inventory? How are housing prices affected?” with lots of talk about the foreclosure pipeline in judicial states like Florida. (For the uninitiated, “judicial state” means that foreclosure proceedings go through the court system, which considerably slows the clearing the distressed housing market.) Here’s the very complex answer: Inventory up, prices down. - Altos Research

————

(has analysis) New Home Sales: December 2010 - by Sold at the Top - Today, the U.S. Census Department released its monthly New Residential Home Sales Report for December showing an unusually strong increase of 17.5% in sales nationally since November as a direct result of a strikingly errant 71.9% monthly increase in sales in the West region. … What is responsible for this explosive sales level in the West will have to be determined but for now let’s take the 90% confidence interval of + or - 31.2% for what it’s worth and wait for the revisions. … - Paper Economy Blog

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment