Washington’s Dilemma - Gregor Mcdonald - Washington is bluffing that it will not bail out California, and every other state suffering from collapsed revenues and massive job losses. … Frankly, unless Washington prints money and bails out every state that needs capital, including California, federal power will decline amidst this severe economic recession, and the process of a soft American devolution will begin. … Gregor.us

————

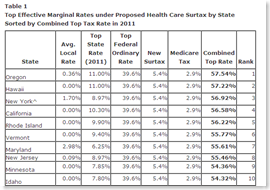

has great chart of 42 locations - Could the top tax rate hit 60%? - Kurt Brouwer - FundMastryBlog

————

Fed balance sheet rises back above $2 trillion - The U.S. Federal Reserve’s balance sheet rose back above $2 trillion after dipping below that level earlier this month, bolstered by increased holdings of agency mortgage-backed securities, Fed data showed on Thursday. - Reuters

————

First Read of House Healthcare Reform Act (H.R. 3200) - … I would like to focus on the consumer benefits of the Act first, and then what I see as the positive impact for the enlightened private health insurers. … - by clickbroker.blogspot.com

————

Robert J. Samuelson - We Want More Government - Just don’t ask us to pay for it. - … Balancing the budget in 2020 would require a tax increase of almost 50 percent from the past half century’s average. … - Newsweek

Testimony - Statement of Douglas W. Elmendorf - Director - The Long-Term Budget Outlook before the Committee on the Budget - United States Senate - CBO.gov

————

Robin Hood Tax Policy - Bruce Bartlett - This week, House Democrats proposed that most of the funding for their health reform plan should come from an income tax surcharge of 1% on those earning between $350,000 and $500,000; 1.5% on those with incomes between $500,000 and $1 million; and 5.4% on those making more than $1 million. Since the surtax is levied on adjusted gross income, it applies to dividends and capital gains even though they are taxed at a lower rate than ordinary income. Former Labor Secretary Robert Reich calls this “the most blatant form of Robin Hood economics ever proposed.” An outspoken liberal, Reich meant this as praise. - Forbes

————

The Bernanke Market - Andy Kessler - We won’t get real growth until Congress and Treasury get policy right. - Wall Street Journal Opinion

————

Ex-Fannie Mae Chief to Join Fortress - The former chief executive of Fannie Mae, Daniel H. Mudd, who was ousted in a government takeover of the mortgage-finance giant, is expected to join the Fortress Investment Group, the big publicly traded alternative investment firms, people briefed on the matter told NYT Dealbook.

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment