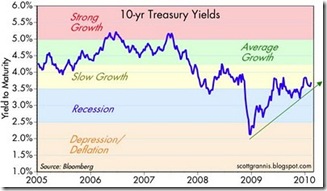

The 10-yr Treasury signal - Scott Grannis - This chart should not be interpreted scientifically. It is my interpretation of what the yield on 10-year Treasury bonds reveals about the market’s outlook for U.S. economic growth. - Calafia Beach Pundit

————

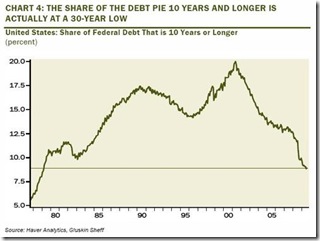

Bullish take: The Stars Align for Long Bonds - Jesse Felder - My Back Pages

————

I Think Bernanke Just Indicated a Tightening - Posted by Larry Doyle - Sense on Cents

————

Fed in Talks With Money Market Funds to Help Drain $1 Trillion - By Craig Torres and Christopher Condon - … as policy makers prepare for the first interest-rate increase since June 2006, according to a person familiar with the discussions. … Money-market funds may welcome the opportunity to trade with the Fed after the financial crisis reduced the supply of safe assets in which they can invest … - Bloomberg

————

Fifth Third eyes TARP repayment this year - Repayment "most likely" in second half of 2010 – Reuters

————

Primary Bond Markets Seize Up - Vincent Fernando - Whether or not a Greece bailout is good or bad for fixed income in the long run, one thing is for sure: High-grade debt issuance this week collapsed 90% from normal levels. - Money Game at Business Insider

————

FIGHTING THE FED: WHAT DOES IT MEAN? - Jeff Miller - A Dash of Insight

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment