JP Morgan Told Judge To Stop Paying Mortgage To Become Eligible For Loan Modification - Submitted by Tyler Durden - … according to JP Morgan, who service the loan, the only way Sikora would be eligible for loan modification would be if he were in delinquency, which is what they advised him to do. That’s right - a bank formally told a client to willfully default on a mortgage. … And the kicker: this judge, who voluntarily stopped making payments even though he knew full well this was against his contract, and knew he was in effect scamming the system, tried to be a Supreme Court judge on three separate occasions! … - Zero Hedge

An Example Of Bank Of America Refusing To Provide An Original Mortgage Note - Submitted by Tyler - Durden - … That said, we would like to present one instance of Bank of America responding negatively to just such a demand by a Zero Hedge reader, in which the bank’s Home Loans unit outright refuses to provide the requested information hiding behind a lack of affirmative responsibility. Specifically, the response from the Qualified Written Request Group notes: "you cite no legal authority that supports your claim that you are entitled to view the original Note, and we are not aware of the existence of any such authority. Accordingly BAC Home Loans respectfully declines this request. If you wish to pursue this matter further, please provide such legal authority." … - Zero Hedge

————

Citigroup 46% Gain Masks Flawed Mortgages Sold to Freddie Mac - By Bob Ivry and Bradley Keoun - … the New York-based bank is still selling mortgages that violate quality standards, according to an internal Freddie Mac review obtained by Bloomberg. Fifteen percent of the performing loans Citigroup sold to the government-owned mortgage-finance company in the second half of 2009 and the first half of 2010 had such flaws as missing appraisals or insurance documents or income miscalculations, according to the review of 375 mortgages. The target for defects should be about 5 percent, said Tim Rood, a former executive with Freddie’s sister agency, Fannie Mae, and now managing director at Washington-based advisory firm Collingwood Group LLC. … - Bloomberg Businessweek

————

Are Servicing Standards And QRM Rulemaking Compatible? - BY JOHN CLAPP - Should federal regulators take up loan servicing standards as part of the Qualified Residential Mortgage (QRM) rulemaking process? That’s the question confronting the Securities and Exchange Commission, the Federal Deposit Insurance Corp. (FDIC) and other parties involved in determining QRM criteria. – MortgageOrb

————

VA directs mortgage servicers to pay short sale relocation assistance - by JON PRIOR - The Department of Veterans Affairs directed its mortgage servicers to provide $1,500 in relocation assistance to borrowers leaving their home after a short sale or a deed-in-lieu of foreclosure. – Housingwire

————

What Happens When Lenders “Walk Away” From a Home - Chris Moore - … But what happens when a bank “walks away” from a home that has been foreclosed on? According to a recent report from the Woodstock Institute, it threatens the stability of whole neighborhoods. The recently released study, which primarily focused on the Chicago area, reports that mortgage services may choose to reduce the costs associated with a long term vacant home by walking away from the foreclosure process instead of completing it. Ultimately the cost of dealing with the vacant properties, from securing them to demolishing them falls on the city, which will cost the city of Chicago an estimated $36 million. -… - Loan Rate Update

————

(has court decisions) Past Rulings by New York Judge Schack Reached Ibanez-Like Conclusions - Yves Smith - Judge Arthur Schack might be the American Securitization Forum’s worst nightmare if more people started paying attention to his rulings. The Brooklyn judge has gotten a lot of media coverage for his lack of patience with “dog ate my homework” excuses from bank plaintiffs in foreclosure cases, as manifested by how often he has dismissed cases with prejudice (meaning those parties cannot return to court on the same matter). … In another blow to securitization industry efforts to minimize the recent Massachusetts Supreme Judicial Court decision in Ibanez (or perversely, spin it as a victory), some of Judge Schack’s earlier decisions come to conclusions similar to those of Ibanez … - Naked Capitalism

————

US CMBS rallies as bid-lists boom - The US CMBS market saw a frenzy of bid-list activity last week, with traders reporting a dramatic increase in supply. At the same time, a fast-moving rally in the lower parts of the capital structure is boosting pricing levels even further. "We’ve seen a continuation in the way of bid-lists and a huge rally in the belly of the curve," one CMBS trader says. He adds that despite the top of the capital structure withdrawing slightly, AJ and mezzanine cashflow bonds have seen significant client demand. "The AMs - which is in the 20-30 part of the capital structure - have been up anywhere from 4-5-6 points." - has more specific price color - Structured Credit Investor

————

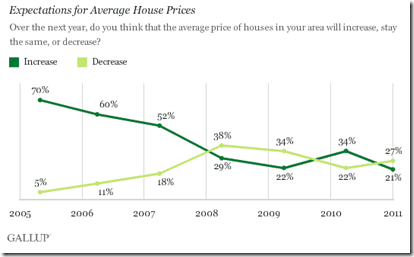

Buyer’s Market in Housing to Continue - Tim Iacono - More evidence of a continuing buyer’s market in housing and of a double-dip for home prices comes via this Gallup poll where Americans seem resigned to little improvement in the nation’s property market due to the glut of foreclosures and weak job growth. - The Mess That Greenspan Made

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment