always good to check - Checking In On the Four Bad Bears - By Paul Kedrosky - Infectuious Greed

————

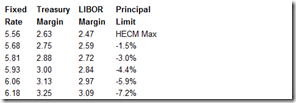

Reverse Mortgage Rates – Long-term rates rose materially last week and the average HECM borrower will receive $2,750 of initial benefit. The good news is that a 3.50% margin CMT HECM is right at a break point. A 3.51% margin would pay another $2,750 less. - Reverse Mortgage Daily

————

Net Global Securitisation Down 79% in 2008 - Net global securitisation issuance slumped by 79 per cent from $2,138bn in 2007 to $441bn in 2008, according to IFSL’s Securitisation 2009 report. - Research Recap

————

David Rosenberg on Second Derivatives - has 2 points - Merrill Lynch’s soon-to-be-former chief economist David Rosenberg published an interesting note today regarding the market’s weird fascination with second derivatives. The economy is still contracting, but not as steeply of late. Rosenberg makes the point that a shallower fall is not the same as recovery - Option Armegeddon by Rolfe Winkler

————

Low Rates Put Some Borrowers In a Quandary - NICK TIMIRAOS - Holders of ‘Hybrid’ ARMs Ponder: Rely on Resetting Lower, or Refinance Now? - Wall Street Journal

————

WaMu Credit Card Excess Spread Collapses - Posted by Tyler Durden - Some more credit card calamities compliments of Bond View. Unprecedented lows for Washington Mutual’s credit card master trust excess spread: a collapse from 4.44% to 1.12% in 1 month, while the loss rate has ballooned to record level. - Zero Hedge Blog

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment