Here’s Your 60-Second Version Of The 2011 Barron’s Roundtable - Joe Weisenthal - Money Game at Business Insider

————

Pimco Takes Over Fund Sales From Allianz After Assets Surge - By Sree Vidya Bhaktavatsalam - In a step toward more independence, Pacific Investment Management Co. is taking control of fund sales from parent Allianz SE after assets at the bond manager jumped sixfold since the takeover a decade ago. Pimco is waiting for regulatory approval to open a broker- dealer and plans to transfer 170 salespeople from Allianz to sell its mutual funds in the U.S. - Bloomberg Businessweek

————

Weekly Update on Gasoline Prices - Doug Short - Here’s a chart based on the weekly gasoline price update from the Department of Energy with an overlay of Light Crude, which closed today at 92.15. - dShort.com

————

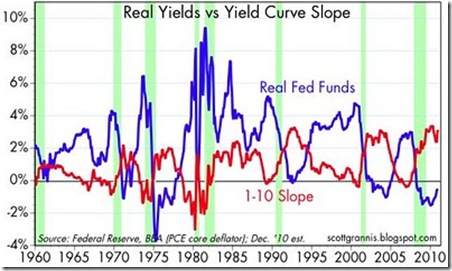

Reading the bond market tea leaves - Scott Grannis - This chart illustrates some enduring truths about monetary policy, Treasury yields, and the health of the economy, so it’s worth revisiting from time to time. Right now it’s sending a strong message: monetary policy is very accommodative, and poses virtually no risk to the economy. - Calafia Beach Pundit

————

China and the U.S. Dollar’s Role as the World’s Reserve Currency - Brian Wesbury - Seeking Alpha

————

THE BOND MARKET OUTLOOK - BY CULLEN ROCHE - Pragmatic Capitalism - Sorry to double up on you with videos here, but Jeff Gundlach, Founder of DoubleLine Capital was on CNBC earlier today and provided an excellent overview of the bond market. In summary he says:

High yield corporates are VERY expensive.

Investment grade corporates are relatively attractive.

Municipal bonds are unattractive due to the potential for future turmoil.

US Treasuries are more attractive than all three of the above on a relative basis.

Government backed mortgage debt remains attractive.

————

(has letter worth reading) David Einhorn & Greenlight Capital’s 2010 Year-End Letter - David Einhorn’s hedge fund firm Greenlight Capital has returned 21.5% annualized net of fees since inception in May 1996. For 2010, his various hedge funds returned 12.5%, 14%, and 15.9%. You can see how that compares to other managers in our 2010 hedge fund returns summary. Einhorn was positioned defensively last year due to the uncertain economic environment and such positioning led to slightly under-performing the market indices. - Market Folly

————

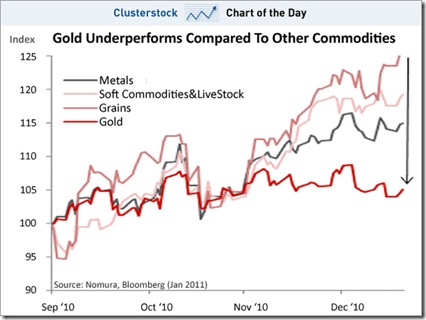

(Gold) Guess Which Major Commodity Has Performed The Worst Since QE2 - Gregory White - … Now Nomura says it may be about to head lower. That’s because gold’s relationship with U.S. real rates suggests it should lose another 8% of its value, so long as U.S. real rates continue to rise, according to Nomura. - Clusterstock at Business Insider

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment