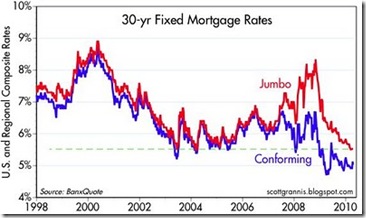

Still no sign of a threat to housing - Scott Granis - Despite the conclusion last month of the Fed’s program to purchase $1.25 trillion of mortgage-backed securities, today there is no sign that this has had any meaningful impact on mortgage interest rates. In fact, rates on 30-year fixed-rate jumbo mortgages are now as low as they have ever been. Furthermore, the spread between jumbo and conforming mortgages is now down to 50 bps - Calafia Beach Pundit

————

Bank of America yanks Countrywide Financial customers’ credit lines - By David Lazarus - BofA, after reporting a $3.2-billion quarterly profit, says it has to cut off former Countrywide borrowers’ home equity credit lines because of financial conditions. … "This decision was not based on your credit record or your performance in paying your home equity line of credit and will not adversely affect your credit score," BofA says in its non-renewal notices. "This decision was based solely on current conditions in the financial markets." … - LA Times Business

————

the pricing race continues - MetLife Lowers Margin for Adjustable Rate HECM Products - Only a few weeks after releasing a no origination and servicing fee fixed rate reverse mortgage product, MetLife announced to wholesale partners it’s lowering margins for adjustable rate HECM products. Previously the company offered margins ranging from LIBOR 250 to LIBOR 325 for its adjustable rate reverse mortgage products, but is now lowering margins to LIBOR 175 and LIBOR 200 through its wholesale channel - Reverse Mortgage Daily

————

thoughts on delinquencies and distressed home sales - Earning More by Setting Aside Less - John P. Hussman, Ph.D. - Hussman Funds

————

Jerry Brown seeks to force Moody’s to release evidence of role in housing meltdown - By Tiffany Hsu - The state attorney general wants Moody’s to respond to a subpoena in a probe of why the firm gave glowing ratings to shaky securities. Moody’s says he’s looking for documents that don’t exist. - Los Angeles Times

————

Mortgage aid program said more vulnerable to scams - By CHRISTOPHER S. RUGABER, AP Economics Writer – WASHINGTON – Recent changes to the Obama administration’s mortgage assistance program may make it more vulnerable to fraud, a government watchdog says - Yahoo News

————

First-Time Buyers Take Larger Share of Home Sales in March - by DIANA GOLOBAY - … First-time homebuyers made up a record high share of sales in March, according to the latest Campbell Surveys poll of more than 1,500 real estate agents nationwide.

Of all home purchases in the month, first-time homebuyers accounted for 48.2% … - HousingWire

————

Financial Literacy and Subprime Mortgage Delinquency: Evidence from a Survey Matched to Administrative Data - Kristopher Gerardi, Lorenz Goette, and Stephan Meier -

Studying data derived from a sample of subprime mortgage borrowers, the authors raise the possibility that limitations in some borrowers financial literacy contributed to the subprime mortgage crisis. - FRB Atlanta Working Paper 2010-10

————

Is 2012 the Year Loan Losses Turn the Page? - By Matt Monks - A consensus is emerging among industry watchers that banks will return to so-called normalized earnings by 2012, with loan losses finally easing to pre-recession levels. JPMorgan Chase & Co. bolstered that view when it said last week that it saw clear signs of improvement in its troubled mortgage and credit card portfolios in the first quarter - US Banker

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment