Will Obama’s GSE Plan Include FDIC-Like System for MBS? - By Donna Borak, American Banker - After months of silence, the Obama administration is close to spilling the best-kept secret in town: what it wants to do with Fannie Mae and Freddie Mac. … "Whatever it is, it’s going to be fairly modest and rely heavily on a continuing government guarantee of some shape or form — of either Fannie and Freddie continuing or some new entity that gets some explicit government guarantee and supposedly pays for it," said Edward Pinto, a fellow at the American Enterprise Institute and a former chief credit officer at Fannie. … - Bank Investment Consultant

————

Reverse Mortgage Volume Falls 35% During 2010 - … The number of HECM endorsements fell slightly to 6,554 units during December, down 0.1% according to data from Reverse Market Insight. However, reverse mortgage volume fell 35% during 2010, with 72,748 units being endorsed in 2010. Lower home values have played a role in the drop in endorsements, but the number of lenders originating reverse mortgages fell 28.9% during the year said RMI. … - Reverse Mortgage Daily

————

Proper Document Diligence Will Stem Compliance Losses - BY MIKE WILEMAN - The soaring number of residential foreclosures, personal bankruptcies and mortgage modifications taking place today is exposing the failure of many originators and servicers during the boom years to properly record and store vital mortgage documents. - MortgageOrb

————

Brownstein’s Mortgage Metaphysics Drives 50% Gain in Top Global Hedge Fund - By Anthony Effinger and Katherine Burton - For 20 years, Don Brownstein taught philosophy at the University of Kansas. … The career change paid off. Brownstein is the founder of Structured Portfolio Management LLC, … Brownstein and William Mok, Structured Portfolio’s director of portfolio management, won’t say exactly how they made their 2010 killing. Their longtime strategy is to develop models that predict when homeowners will refinance their mortgages — a move that reduces interest payments on mortgage bonds. They then buy securities they conclude are underpriced. … - Bloomberg

————

Embattled Virtual Mortgage Registry MERS Retains Top Lobbying Talent - Michael Beckel - One company embroiled in the nation’s property foreclosure crisis is not unprepared for a fight. In Washington, D.C., Merscorp Inc. has retained several well-heeled lobbyists and invested hundreds of thousands of dollars in lobbying efforts since the start of the mortgage crisis and economic meltdown. - Stop Foreclosure Fraud.com

————

Equator’s Vella: Short sales set to swell 25% in 2011 - by JON PRIOR - … John Vella, the chief operating officer at technology provider Equator, sat down for this edition of In This Corner to explain just why he thinks 2011 will be the year of the short sale. .. - HousingWire

————

Shadow Lot Supply - John Burns - What happened to 1.3 million lots? - In the last 4 years, the public builders have reduced their land holdings from 2.2 million to 700K lots, and only built on about 200K of them during that time period. What happened to the remaining 1.3 million lots? - John Burns RE Consulting

————

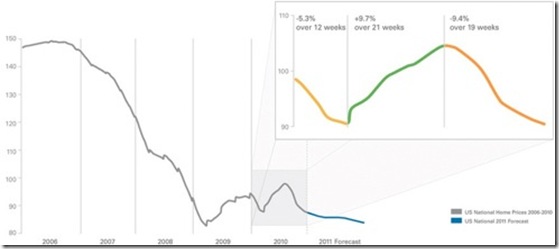

Home Values Will Continue to Decline in 2011 says Clear Capital - Home prices fell 4.1 percent during 2010 and another 3.7 percent decline is expected in 2011 according to Clear Capital’s latest Home Data Index Market Report. (has link to report) - Reverse Mortgage Daily

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment