One of my new favorite blogs is Zero Hedge. Lots of thought provoking original content.

Here are 3 posts that fascinated me. The underlying theme is similar to others we have seen. Many things persist until they simply run out of steam. Often the aftermath is not pretty.

going til it stops - Quantology Revisited: The Negative Convexity Implications Of Delta-Hedging - Posted by Tyler Durden - … I thank an anonymous reader …taking the

convexity argument one step further from merely structured finance to the entire market … But a simplified attempt: we have crossed into territory where the negative convexity consequences of delta hedging will keep on pushing the market in a straight line in whatever direction it is moving until we see a violent reversal and the delta hedge breaks due to lack of vol to “feed it”, which will be, in the parlance of our times, the market’s epic fail… - Zero Hedge

————

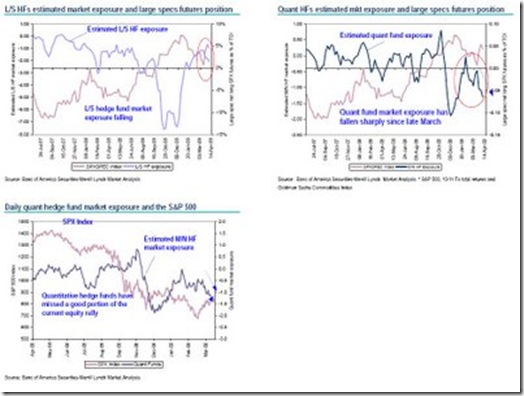

this one is really scary - who is GETCO? - The Incredibly Shrinking Market Liquidity, Or The Upcoming Black Swan Of Black Swans - by Tyler Durden - … Let’s back up. I recently posted a chart which tracks equity market neutral strategies: in essence a cross section of quant funds for which there is public performance tracking. The chart is presented below … Zero Hedge

Merrill Let Loose On The Quant Scent - In a report released yesterday, it is somewhat gratifying that Merrill Lynch analyst Mary Ann Bartels agrees with Zero Hedge conclusions about possible near-term market volatility events as a result of quant fund deleveraging. - Zero Hedge

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment