![]()

Posing Swine, from EcoSherpa.com.

The upper limit for Fed Funds has been stuck at 0.25% since Dec 2008. What does the Fed do when the Fed Funds rate is zero, or close enough to zero for government work?

We don’t need to guess or speculate. Depending upon where you sit (or sat, if you were the Chairman of Bank of America), the answers are not pretty. During these days of swine, the Fed has posed as:

- An economist;

- A booster; and

- A thug.

Each pose was – in its own way – negative.

Below, in decreasing order of sophistication, is what the Fed did when the Funds rate - the Fed’s most important traditional policy lever – was in the “neighborhood” of zero. The Fed:

- Leaked conclusions of an economic staff paper justifying lower rates;

- Released a statement saying that we’ve turned the corner, even as the economy continues to tank; and

- Indirectly “threatened” to remove the Chairman of a less-than-fully-compliant bank.

We shall now review each pose.

Posing As An Economist

Two days after flu was first diagnosed outside of Mexico, a former economic advisor to President Bush opined that “with unemployment rising and the financial system in shambles” we might need “more negativity.”

He described how the Fed could create negative currency returns and encourage stimulative consumer spending by either:

- Unconventionally repudiating some of the currency in circulation; or

- Conventionally promoting inflation.

One week later, the Fed selectively leaked a study prepared for the March ‘09 meeting that “the ideal interest rate for the US economy … [would currently] be minus 5%” – based on a Taylor-rule approach.”

As described in a 2007 Dallas Fed Economic Letter, Stanford’s John Taylor proposed that central bank policy can be approximated by a simple model that considers both the:

- Inflation Gap: Difference between current and desired inflation; and the

- Output Gap: Difference between current and desired output or production.

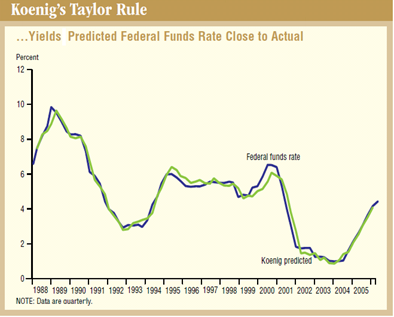

Fed economist Evan Koenig modeled the inflation and output “gaps” with forward-looking consensus forecasts, and virtually reproduced historical Fed Funds rates, as seen in the chart below:

Figure 1: Koenig’s Taylor Rule, 1988 - 2006

A.Z. Fernandez & A. Nikolsko-Rzhevskyy, FRB of Dallas Economic Letter,

Measuring the Taylor Rule’s Performance, Jun 2007.

Since nominal rates can’t be negative (without “repudiation”), the leaked study suggested that the Fed should maintain unconventional policies that provide stimulus equivalent to an interest rate of minus 5%.

Not surprisingly, on 1 May 2009, the Fed announced an expansion of the Term Asset-Backed Securities Loan Facility (TALF). TALF will now:

- Make 5 year loans (prior limit had been 3 years); and

- Accept Commercial Mortgage Backed Securities as eligible collateral. (TALF, as the name suggests, had originally been an ABS-only program.)

“Unconventional” enough for you?

Posing As A Booster

On 29 April, the World Health Organization changed the status of the flu outbreak to level 5 – “pandemic considered imminent.”

That morning, the Commerce Department released figures indicating that the US economy shrank at an annualized rate of 6.1% in 2009Q1. The worse-than-expected-decline marked the first time that the US economy had contracted for three consecutive quarters since 1975. Unemployment, at 8.5%, is at a 25 year high.

That afternoon, the Fed released its April policy statement that was – for Fedspeak - very optimistic. It seemed designed to reverse, or negate, the pessimistic Q1 release. It included the following:

- Information received since the … Committee met in March indicates that the … the pace of [economic] contraction appears to be somewhat slower… Although the economic outlook has improved modestly since the March meeting… economic activity is likely to remain weak for a time…

- The Committee continues to anticipate that policy actions … and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

Markets surged on these words.

Reuters reported that global stock markets jumped more than one percent as investors “bet on the stabilization of the world economy.” A London equity strategist called the “FOMC [statement] very positive, and that’s exactly what investors were looking for.”

Posing As A Thug

Finally, on the evening of 29 Apr, Bank of America (“BofA”) shareholders voted to oust chief executive Kenneth Lewis as chairman of the board. The vote was described as “an unambiguous vote of no confidence. …The dominant influence that [Kenneth Lewis] had at Bank of America is now a thing of the past.”

The vote marked the beginning of the end of a decapitation that began in 2008.

As described by the Wall Street Journal on 23 Apr, Kenneth Lewis testified under oath that:

- Losses at Merrill Lynch were far more substantial than BofA had originally believed when it agreed to acquire Merrill in September of 2008;

- BofA wanted to back out of the deal;

- Paulson threatened to fire him and the entire BofA board if they did so; and

- Paulson confirmed that he made the threat and that it came at the request of Ben Bernanke.

The courts will eventually determine what was, or was not, said – and by whom. If CEO Lewis’ account is affirmed, it will certainly mark a new low for the Fed, and reflect negatively upon it.

Having lived through it, we now know what the Fed will do when Fed Funds approach zero. The Fed strikes various poses – as an economist, a booster, and (perhaps) a thug. Which is most effective? I’m not sure. Take your pig.

![]()

I used to work with numbers for a living. I hope that I haven’t been a boar as I root about for a new job, or at least my next idea. Till next time.

2 responses so far ↓

1 Ira Artman’s Sterling Slivers: 40 Weak Years … And A Rule? - The Long and Short of Bond & Equity Returns // May 12, 2009 at 6:06 pm

[...] used to work with numbers for a living. Pigs, pandas, and mules – oh my! - could my next job be in Kansas as I continue my search for a new [...]

2 Ira Artman’s Sterling Slivers: Low Flying Planes, Cheerios, and Monetary Policy – We’re From The Government And We’re Here To Help You // May 13, 2009 at 12:01 pm

[...] Financial Times reports (see Days of Swine and Poses) that the Fed believes that current interest rates should be equivalent to negative 5%, using the [...]

Leave a Comment