Two widely respected investment firms – Research Affiliates and Deutsche Bank – recently reviewed the relative performance of diverse asset classes over decades (Research Affiliates) and months (Deutsche Bank).

Each provides justification – even in tough times like these – that portfolio diversification rules!

The Long View – 40 Years

“Why bother with bonds?” asks Robert Arnott, the Chairman of Research Affiliates.

Writing in this month’s Journal of Indexes (Bonds: Why Bother, May – Jun 2009), Arnott reviews more than 40 years of market history.

He provides investors, betrayed by the unfulfilled “promise” of equity-burdened portfolios, with six answers:

- Over the past 40 years, Treasury bond returns exceeded stock returns.

- This is not a fluke - the equity risk premium (the excess return obtained by holding stocks, rather than bonds) is not reliable. Equity investors must frequently suffer through long periods of disappointment, occasionally interrupted by “some wonderful gains.”

- The only thing that goes up in a market crash is correlation between asset classes.

- Bonds have been an effective way to reduce portfolio risk.

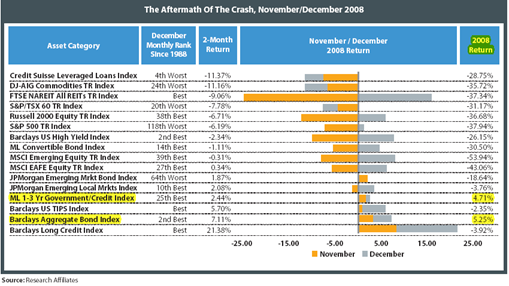

- 2008 returns on 14 out of 16 broad asset categories were negative. In a year when the S&P 500 dropped 38%, broad US bond market indexes (such as the BarCap Aggregate Bond Index and the Merrill Lynch 1-3 Year Government/Credit Index) rose by 5%. See Figure 1, below, for the details.

- Long-term investors can improve their portfolio returns by broadening their horizons to include stocks and bonds that don’t resemble conventional indexes, such as the S&P 500 or the BarCap Aggregate. Note: These include high yield corporate credits. Let’s turn to those - now.

Figure 1: Aftermath of Crash (Full year 2008 Returns at right, highlighting by author); from R. Arnott, Bonds: Why Bother?, Journal of Indexes, May-Jun 2009.

The Short View – Since July 2007

For a short-term tilling of similar terrain, plow through the asset class review of Credit vs Equity, Which Has Outperformed? (Deutsche Bank, Jim Reid and Nick Burns, 11 May 2009.)

While news has been dominated by the equity market resurgence, the Deutsche Bank team provides answers to the following question:

- Which asset class has out-performed: bonds, credit or equities?

The answer – naturally – depends upon the date that you choose to begin your analysis.

Reid and Burns assess the performance of bonds, credit, and equities over more than a half dozen different time horizons with different starting dates.

They focus upon intervals beginning with the final week of each of the following months:

- July 2007;

- September 2008; or

- December 2008

and share a common ending date of the first week of May, 2009.

Following a detailed review, Deutsche Bank concludes:

- High yield corporate credit has clearly outperformed equities (although not Government bonds) since the beginning of the crisis and also since the end of 2008Q3.

- Year-to-date 2009, high yield credit has outperformed all other credit and equity sectors.

Note: While the Deutsche Bank team used broad worldwide indices accessible to institutional investors, my analysis (below) includes charts of my own construction. These charts reflect performance of asset classes similar to that referenced by Deutsche Bank. They are based on total return data (from Yahoo!) for representative mutual funds, as follows:

- GNMA Mortgages: Vanguard GNMA (VFIIX)

- High Yield Corporate: T Rowe Price High Yield (PRHYX)

- S&P 500: Vanguard Index 500 (VFINX)

My commentaries, while broadly consistent with Deutsche Bank’s views, reflect the performance of the US mutual fund proxies that I have chosen as “stand-ins” for the Deutsche Bank asset classes.

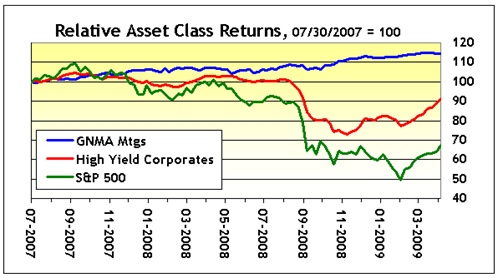

Since July 2007

- The asset class that has been the best since the start of the crisis has been Government-backed bonds. Equities have delivered the worst performance. Although high yield credit significantly under-performed other credit sectors, it still managed to outperform equities.

Figure 2: Relative Asset Class Returns Since 07-30-2007

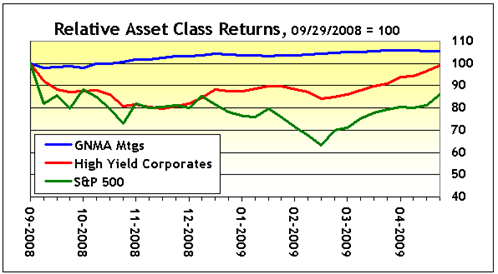

Since September 2008

- Government backed bonds still produced healthy returns, and equity markets generally delivered the worst market performance. High yield corporates managed to recoup virtually all of their losses by the beginning of May.

Figure 3: Relative Asset Class Returns Since 09-29-2008

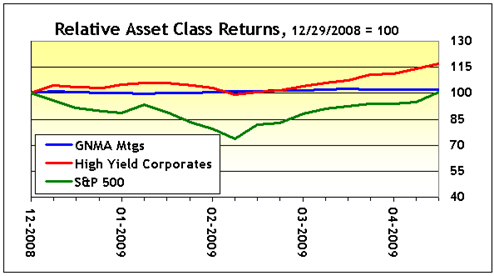

Since January 2009

- Government-backed bonds have been remarkably steady, but produced virtually no return. While equities experienced almost a 30% decline by early February, they had clawed their way back by early May. High yield credit, however, produced the strongest year-to-date returns, in excess of 17%.

Figure 4: Relative Asset Class Returns Since 12-29-2008

The dismal performance of equity markets over the past 40 years has reinforced the importance of bonds in a diversified portfolio. Investors looking to diversify their portfolio and enhance their returns, even in troubled times, should also consider investing in “unconventional” asset classes such as corporate credit.

![]()

I used to work with numbers for a living. Pigs, pandas, and mules – oh my! - could my next job be in Kansas as I continue my search for a new job, or at least my next idea? Till next time.

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment