GSEs, QRM Definition/Risk Retention Could Shape Future PL MBS - By Bonnie Sinnock - It may not be clear when the private-label securitized market will come back, but the developments that will likely shape it are coming into focus: the government-sponsored enterprises and the pending qualified residential mortgage definition/risk retention regulation. - National Mortgage News

————

Revised adjustable-rate mortgages emerging from lenders’ deep freeze - By KENNETH R. HARNEY - After years of virtual exile from the home loan arena, adjustable-rate mortgages are starting to attract applicants again, according to a new survey of 112 lenders by mortgage giant Freddie Mac. Adjustables accounted for just 3 percent of new home loans in early 2009 but are projected to be the choice for nearly 10 percent of borrowers this year. In the jumbo and superjumbo segments, the share will be larger, according to Frank Nothaft, Freddie Mac chief economist. - Toledo Blade

————

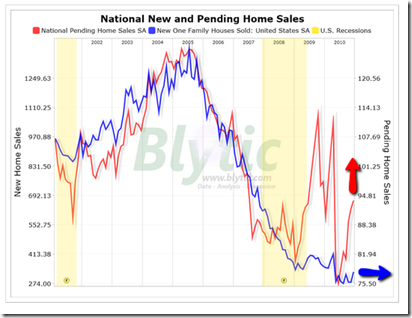

(looks at disparities) Comparing New and Pending Home Sales - Sold at the Top - Paper Economy Blog

————

Bank legally bound by loan-modification promise - Bob Egelko - A bank is legally bound by its promise to try to work out a loan modification with a homeowner to avoid foreclosure, a state appeals court has ruled. Thursday’s decision by the Second District Court of Appeal in Los Angeles involved a homeowner who said she refrained from protecting her home in a Bankruptcy Court filing after the bank promised to negotiate new loan terms - then foreclosed and evicted her. - SF Chronicle

————

More Judges Pushing Back on Dubious Foreclosure Documents - Yves Smith - Even though this example involves only three judges in Ohio, don’t underestimate its significance. The fact that judges of their own initiative have started insisting that all attorneys provide certifications of foreclosure-related documents, a standard now in effect in New York state, shows how much their credibility has fallen. From the Columbus Dispatch … In response to a national outcry over fraudulent foreclosure filings, three Franklin County judges are requiring lawyers to verify that all of the documents in residential-foreclosure actions are valid. …- Naked Capitalism

————

The home’s changing role in family finances - By Christine Dugas - Homeownership used to be the bedrock of the American dream, but the economic storm and its lasting effects have radically changed how everyone — no matter what stage of life they’re in — looks at their home. - USA TODAY

————

Uncertain Path Ahead For U.S. Mortgage Giants - by SCOTT HORSLEY - … "It’s safe to say there’s no clear consensus yet on how best to design a new system," Treasury Secretary Timothy Geithner said last summer. "But this administration will side with those who want fundamental change." The shape of that change is still forming five months later. Conservatives like Pollock say the government should generally get out of the business of bankrolling mortgages and leave most of that market to the private sector. Not everyone agrees. … - NPR.org

————

Agencies Announce Start of Initial Registration Period Under S.A.F.E. Act’s Mortgage Loan Originator Provisions - Washington-The federal bank, thrift and credit union regulatory agencies, along with the Farm Credit Administration, announce that the Nationwide Mortgage Licensing System and Registry will begin accepting federal registrations today. - Press Release FR Board of Governors

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment