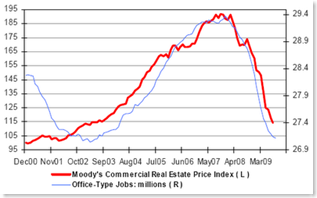

Commercial real estate valuations and office jobs - Commercial real estate valuations seem to coincide quite well with the overall number of office jobs. It’s not necessarily obvious that this should be the case, because commercial properties include retail, multifamily, and other non-office properties. Nevertheless the relationship is striking. - Sober Look Blog

————

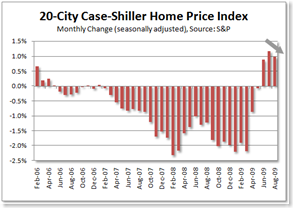

US Housing Price Decline Continues to Slow - The pace of housing price declines in US cities continued to slow in August, but the annual returns of the Case Shiller 10-City and 20-City Composite Home Price Indices still were down 10.6% and 11.3%, respectively from a year earlier. Nineteen of the 20 metro areas and both Composites showed an improvement in the annual rates of decline with August’s readings compared to July … As of August 2009, average home prices across the United States are at similar levels to where they were in the autumn of 2003. … - Research Recap

————

Case-Shiller HPI 2nd derivative problems? - Tim Iacono - Earlier this year, as economic conditions were still getting worse but at a lesser pace, market analysts talked about an improving “second derivative” as a hopeful sign for the future. Is it now time to start talking about second derivatives again? - themessthatgreenspanmande

————

Invesco, Marathon say toxic assets hold value for PPIP - By Nancy Leinfuss - Reuters

————

Home Refinancing May Never Look So Good Again: John F. Wasik - If you need to refinance your home mortgages, don’t wait. It’s not time to play chicken. Lock in the best deal now. Mortgage rates have climbed over the last two weeks, according to mortgage buyer Freddie Mac of McLean, Virginia. … - Bloomberg

————

Big home-loan limits likely to stay till 2011 - posted by Mathew Padilla - The latest from National Mortgage News …: House and Senate appropriators have agreed to extend the current loan limits for Fannie Mae, Freddie Mac and Federal Housing Administration loans for another year as part of the continuing funding resolution Congress is expected to pass this week. “The CR [continuing resolution] maintains the limits for FHA, GSE … single-family mortgages at $729,750 through the end of calendar year 2010,” - OC Register

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment