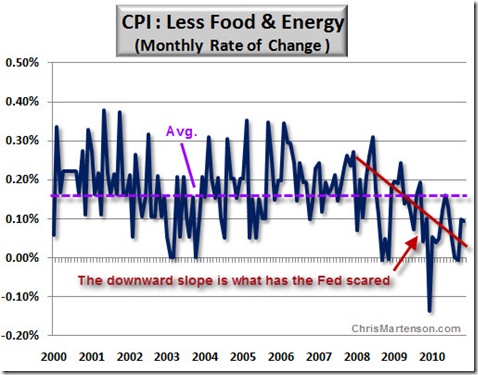

(worth reading) Inflation Is So Much Worse Than We’re Told - Chris Martenson -

————

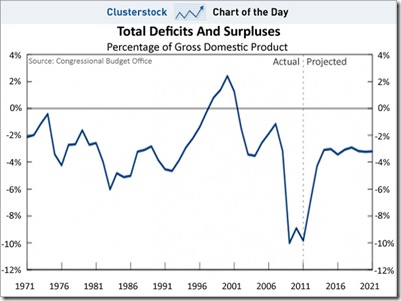

$1,500,000,000,000 - Joe Weisenthal - Just out from the CBO, your estimated deficit for 2011 $1.5 trillion. Here’s some perspective on the deficit as a percentage of GDP. As you can see, it’s not quite a record, but close. - Clusterstock at Business Insider

————

As Bankers Kill Off Mark-To-Market For Good, Former FDIC Chairman Gloats - Submitted by Tyler Durden - … Following the announcement, none other than Bill Isaac, current Chairman of LECG, but far more importantly, former Chairman of the FDIC under Ronald Reagan decided to send out a gloating email to his entire address book explaining what a moral victory it is to kill the MTM monster that is the sole reason for the near collapse of capitalism in 2008, and how truly wonderful it is for everyone to live in perpetual lack of knowledge of what the true value of any company’s assets really is. … - Zero Hedge

Geithner Does Not See Global Inflation As A Concern - Submitted by Tyler Durden -

Zero Hedge

————

Fed Accounting? Is the Problem Solved? - Bib Eisenbeis - Note to Readers: What follows is a very technical and somewhat arcane discussion of a new Federal Reserve accounting issue, but one that has potentially significant policy implications when it comes to the Fed’s ability to execute its exit strategy from its current quantitative easing policy. … - Cumberland Advisors

————

Mark to Market Sanity - Bob McTeer - In 2008 and 2009 I probably blogged more than anything else about needlessly destroying bank capital with a strict application of mark to market accounting. - Bob McTeer’s Econ Policy Blog

0 responses so far ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment