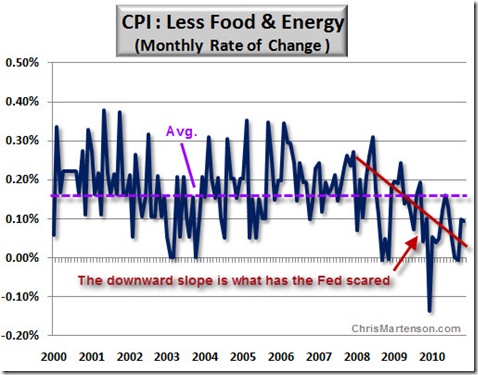

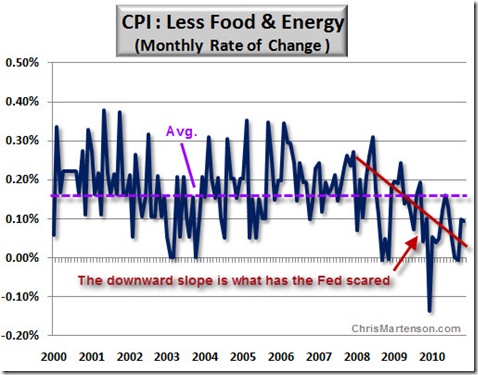

(worth reading) Inflation Is So Much Worse Than We’re Told - Chris Martenson -

————

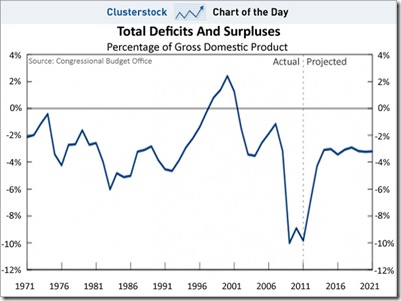

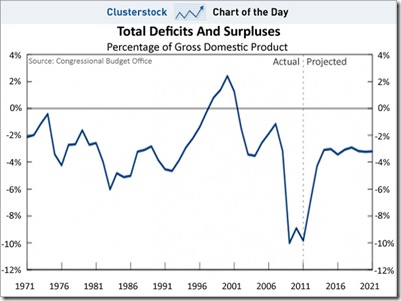

$1,500,000,000,000 - Joe Weisenthal - Just out from the CBO, your estimated deficit for 2011 $1.5 trillion. Here’s some perspective on the deficit as a percentage of GDP. As you can see, it’s not quite a record, but close. - Clusterstock at Business Insider

————

As Bankers Kill Off Mark-To-Market For Good, Former FDIC Chairman Gloats - Submitted by Tyler Durden - … Following the announcement, none other than Bill Isaac, current Chairman of LECG, but far more importantly, former Chairman of the FDIC under Ronald Reagan decided to send out a gloating email to his entire address book explaining what a moral victory it is to kill the MTM monster that is the sole reason for the near collapse of capitalism in 2008, and how truly wonderful it is for everyone to live in perpetual lack of knowledge of what the true value of any company’s assets really is. … - Zero Hedge

Geithner Does Not See Global Inflation As A Concern - Submitted by Tyler Durden -

Zero Hedge

————

Fed Accounting? Is the Problem Solved? - Bib Eisenbeis - Note to Readers: What follows is a very technical and somewhat arcane discussion of a new Federal Reserve accounting issue, but one that has potentially significant policy implications when it comes to the Fed’s ability to execute its exit strategy from its current quantitative easing policy. … - Cumberland Advisors

————

Mark to Market Sanity - Bob McTeer - In 2008 and 2009 I probably blogged more than anything else about needlessly destroying bank capital with a strict application of mark to market accounting. - Bob McTeer’s Econ Policy Blog

Tags: Mortgage Market

There have been eleven bank closures so far in 2011, four of which occurred last Friday. The First State Bank (OK) was sold to Bank 7 (OK), Evergreen State Bank (WI) was sold to McFarland State Bank (also of WI), FirstTier Bank (CO) was placed into the FDIC-created Deposit Insurance National bank of Louisville, which will remain open until Feb 28 to give depositors time to open accounts at other banks, and lastly First Community Bank (NM) was sold to US Bank (MN).

Wells Fargo said it will cut temporary 145 employees from its wholesale mortgage lending division.

But hiring continues. Weichert Financial Services/Mortgage Access, a privately held, top real estate affiliated mortgage company, licensed in 43 states with a significant Northeast presence, is actively hiring licensed loan officers in New Jersey, New York, Connecticut, Pennsylvania, Virginia and Maryland. The company has been around over 30 years. Contact Recruiting Manager Sean O’Flynn at [email protected].

April Fool’s Day is two months from today, and the compensation issue is heating. NAMB issued an “action alert” for members to contact their Senators’ or Representative and urge them to stop the Fed’s Rule on Loan Originators Compensation. Delay or issue a complete compliance guide! “Dial the U.S. Capitol Switchboard at (202) 224-3121…Ask to be connected to your Member of Congress’ office…Urge them to Delay the Fed Rule on LO Compensation Regulation Z: 12 CFR 226. Ask for their e-mail or fax number to send your letter…Write your letter to the Federal Reserve Board and email or fax to your members of Congress.”

Here is Part VI of the compensation Q&A from the MBA and Fed….

Q19. In situations in which a lender acts as a mortgage broker and, thus, is a loan originator for purposes of the rule, if the party has an affiliated settlement service provider, such as a title company, are the bona fide and reasonable charges received by the affiliated settlement service provider considered part of the loan originator compensation?

A. Fed Response - No. The reason for treating affiliates as a single person is to avoid attempts to circumvent the rule by allowing a company to set up two separate companies with different commission structures and permitting its loan officers to deliver loans to either company. This is addressed in Commentary Section 226.36(d) (3)-1. This concern is not presented when a loan originator has an affiliated settlement service provider, because to be excluded from compensation under the rule the fees of the provider for the settlement service must (a) not be retained by the loan originator and (b) be bona fide and reasonable. The bona fide and reasonable requirement is sufficient to address any concern that the loan originator may seek to receive compensation by having its affiliate charge higher fees for its settlement services.

Q20. May a creditor permit certain loan originators to establish rate and point combinations for loans below the creditor’s standard rate and point combinations without first seeking approval of a supervisor, subject to a limits on the amount per loan and the total amount per loans

within given period (such as no more than Y basis points per any individual loan and no more than an aggregate of Z basis points per all loans during a quarter)? This is done to meet competition. The compensation of the loan originators would not vary based on whether or not the rate and points established for a loan was below the creditor’s standard rate and point combinations.

A. Fed Response - Yes. As long as a loan originator’s compensation does not vary based on whether or not the rate and points established for a loan is below the creditor’s standard rate and point combinations, certain loan originators may be permitted to establish rate and point combinations for loans that are below the creditor’s standard rate and point combinations.

Q21. May a loan originator pay some or all of the third party fees of a consumer or otherwise credit the consumer from a premium rate or out of his own pocket?

A. Fed Response - No. The rule prohibits overages and underages tied to terms including rate. The Board has concluded that if it did not prohibit lowering of loan originator compensation, the industry may establish high prices/compensation amounts, and then lower prices and compensation amounts for borrowers who negotiated. The Board views an originator’s agreement to reduce compensation to pay fees as essentially the same as an underage where loan originator compensation is lowered.

Well, not that the market has turned, but the amount of chatter out there in the ranks about ARM loans is increasing by the day. Maybe folks are bored with talk about compensation, buybacks, RESPA, refi’s disappearing, etc. A survey done by FHLMC (uh, Freddie) of over 100 lenders showed that conventional conforming ARMs are starting to attract applicants again, and that their market share may go from 3% in 2009 to almost 10% in 2011. Gone, for the most part, are two-year adjustables, option ARM’s, “pick-a-pay” ARMs, etc., and they’ve been replaced with the 3-1, 5-1, and 7-1. These hybrids have better rates than the 30-yr product, in some cases 1-1.5% better. Better dust off those manuals that define terms like margin, index, and so forth!

more news on Ally Financial, Bank of America, Flagstar, Union Bank, the markets, MBS prices, and Joke of the day – click here.

Tags: Commentary · Mortgage Market · Rob Chrisman

The federal bank, thrift and credit union regulatory agencies, along with the Farm Credit Administration, announced today that the Nationwide Mortgage Licensing System and Registry (Federal Registration) will begin accepting federal registrations, effective immediately.

Under the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) and the agencies’ final rules, residential mortgage loan originators employed by banks, savings associations, credit unions, or Farm Credit System institutions must register with the registry, obtain a unique identifier from the registry, and maintain their registrations.

Agencies

Farm Credit Administration

Federal Deposit Insurance Corporation

National Credit Union Administration

Office of the Comptroller of the Currency

Office of Thrift Supervision

Following expiration of the 180-day initial registration period on July 29, 2011, any employee of an agency-regulated institution who is subject to the registration requirements will be prohibited from originating residential mortgage loans without first meeting these requirements.

(The registration rules exclude mortgage loan originators that originated five or fewer mortgage loans during the previous 12 months and who have never been registered.)

Initial registration: January 31, 2011 to July 29, 2011.

LENDERS COMPLIANCE GROUP is the first and only full service, mortgage risk management firm in the country that specializes exclusively in residential mortgage compliance. The firm provides risk management outsourcing to the mortgage industry, offering a full suite of hands-on and automated services in residential mortgage banking.

Tags: Mortgage Market

Jonathan Foxx is a former Chief Compliance Officer of two publicly traded financial institutions, and the President and Managing Director of Lenders Compliance Group, the nation’s first full-service, mortgage risk management firm in the country.

Jonathan Foxx is a former Chief Compliance Officer of two publicly traded financial institutions, and the President and Managing Director of Lenders Compliance Group, the nation’s first full-service, mortgage risk management firm in the country.

On January 26, 2011, the Federal Reserve Board issued a "Guide" - a "small entity compliance guide" required under Section 212 of the Small Business Regulatory Enforcement Fairness Act of 1996 (SBREFA), as amended.

I have placed "Guide" in quotes because I haven’t seen such a perfunctory and virtually useless issuance from the FRB in quite a long time in a matter of such consequence!

It seems to me that the "Guide" is more of a reaction to the January 13, 2011 letter from the SBA’s Office of Advocacy, which expressed concern, among other things, that the "the Federal Reserve has not analyzed properly the full economic impact of the proposal on small entities as required by the Regulatory Flexibility Act (RFA)."

If this is meant to be a response to that letter, and to comply with the SBREFA, it falls far short of the mark; and, in any event, it surely doesn’t seem to fulfill the statutory requirements carefully reasoned in the SBA’s letter.

Much of the FRB "Guide" is no more than a regurgitation of the "already known" aspects of the Regulation Z amendments affecting loan officer compensation. I doubt our clients will get much help from this document!

The SBA’s letter recommended that the Board publish a compliance guide in the immediate future and extend the time for small entities to comply - now scheduled for April 1, 2011 - to reflect the delay in the availability of the guide.

Nevertheless, at this time it does not appear that a delay is being seriously considered.

In reviewing our Library and Archives, it appears that we have well over 300 documents on the subject of loan officer compensation.

So I decided to open a new section in the Library devoted to COMPENSATION - MLOs. Over time, it will receive more and more relevant documents. Check back or

bookmark the page, if you want to keep track of this controversial subject.

LENDERS COMPLIANCE GROUP is the first and only full service, mortgage risk management firm in the country that specializes exclusively in residential mortgage compliance. The firm provides risk management outsourcing to the mortgage industry, offering a full suite of hands-on and automated services in residential mortgage banking.

Tags: Mortgage Market